UK Clothing & Footwear Sector Report summary

March 2024

Period covered: Period covered: 28 January – 24 February 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Clothing & Footwear Sales

Clothing sales fell xx YoY, while Footwear sales fell xx YoY in February, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

When apparel inflation is taken into account (ONS: xx) this points to significant decline in Clothing sales volumes.

Retail Economics forecasts Clothing sales growth of xx YoY in 2024, with total sales reaching £xx. This is a slight improvement on xx growth in 2023.

Clothing & Footwear sales’ performance in December reflects several downside (-) factors, including:

Mild, wet weather (-): The south of England had its wettest February on record, with much of the region experiencing more than twice the average rainfall.

Low footfall (-): The wet weather impacted fashion sales in a couple of ways – firstly, by keeping shoppers at home, with high streets hardest hit. Footfall overall was down xx YoY, the biggest fall since the pandemic, and high street footfall was down xx

Spring ranges impacted (-): The damp weather also impacted sales of new season items, with shoppers disinclined to buy new Spring ranges and full price items.

Low key Valentines (-): Consumers opted to spend Valentines Day at home, indulging in takeaways and streaming services. Sales of traditional categories failed to drive growth.

Consumer spending

Shoppers chose to hunker down and stay at home throughout the month, with digital content and subscriptions seeing its highest growth as a category since xxx xxx (xx), according to Barclaycard. Restaurant spending, meanwhile, fell xx YoY.

At the same time, consumers are continuing to prioritise spending on holidays. Barclays reported that spending on travel agents (10.1%) and airlines (9.6%) rose YoY, and airlines such as Jet2 lifted profit guidance as spend remained ahead of expectations.

News that the UK had entered a technical recession in February stalled the consumer confidence recovery, GfK’s overall confidence index dipped in February to xx and remained at the same level in March.

Complex customer journeys

The clothing and footwear market is declining due to the cost of living crisis, leading consumers to prioritize spending on other areas like holidays.

Despite the trend, some retailers, like Next, are thriving with a 5% increase in pre-tax profit and nearly 6% growth in group sales, attributed to two decades of investment in technology and infrastructure.

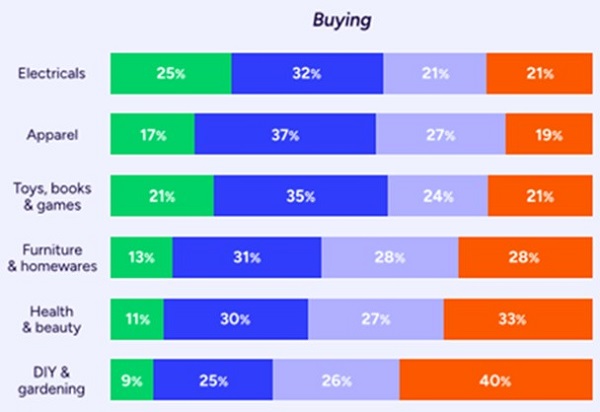

Research indicates that consumer buying behaviours are unpredictable and multi-channel, with a significant reliance on digital channels in the apparel sector, yet only 17% of consumers exclusively shop online.

Take out a free 30 day trial subscription to read the full report.

Omnichannel behaviours uneven across sectors

Source: Retail Economics, Auctane

Source: Retail Economics, Auctane