UK Clothing & Footwear Sector Report summary

November 2023

Period covered: Period covered: 01 - 28 October 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Clothing & Footwear Sales

Clothing sales fell xx% YoY, while Footwear sales fell by xx% YoY in October, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted). With apparel inflation running at xx%, this suggests steep volume declines in the sector.

Clothing & Footwear sales’ slow performance in October reflects several downside (-) factors, including:

Mixed weather (-): The warmest October since 2011, with temperatures peaking at 25°C in the south-east (Met Office), eroded demand for autumn/winter ranges, although sales picked up in the second half of the month with the arrival of unsettled and wet conditions.

Half term (-): October half term saw consumers prioritising other forms of spending, such as travel and hospitality.

Economic uncertainty (-): Coupled with higher mortgage and rent payments, dwindling covid savings and the heating coming back on, beleaguered consumers are thinking very carefully about how they spend their money.

Shoppers wait for Black Friday (-): This caution led shoppers to delay festive spending in October, including on clothing and footwear, preferring to wait for Black Friday deals. This comes as many apparel retailers held off on discounting until closer to Black Friday, maximising full price sales and protecting margins during this critical trading period, after being stung by prolonged heavy discounting last year.

Economic uncertainty

While there was some good news - CPI inflation fell to 4.6%, apparel inflation fell to 6.2%, and real wages grew 1.3% in the three months to September 2023 – consumers are still facing pressures which continue to hit their spending.

Housing costs continue to increase as more homeowners move to higher rate mortgages, with interest rates held flat at 5.25% for the second time by the Bank of England in October. And growing food costs continue to eat into people’s budgets, with food inflation at 10.1%.

These issues are hitting consumer sentiment. The closely watched GfK confidence index dropping nine points in October to -30, marking the sharpest month-on-month decline since December 1994. Willingness to make major purchases fell 14 points in the month to -34.

This economic uncertainty, coupled with October’s wet weather, is reflected in footfall data. Footfall across retail destinations fell by 1.3% YoY in October. This marks the first annual decline since April 2021 (MRI Software).

Barclaycard spending data showed spend in the clothing sector fell for the fourth consecutive month, dropping -3% in October.

Take out a free 30 day trial subscription to read the full report.

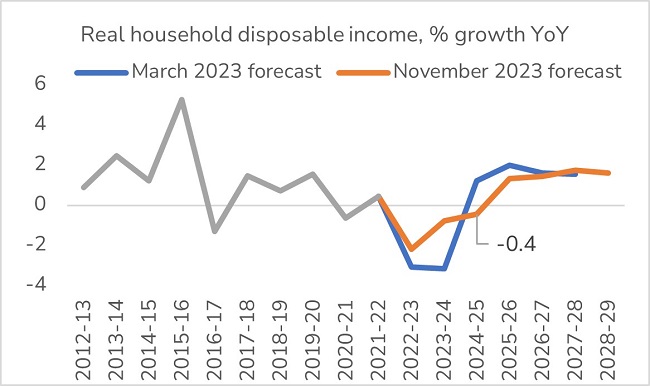

Household disposable incomes set to stay negative over 2024, as wage growth slows and inflation persists

Source: OBR, Retail Economics

Source: OBR, Retail Economics