UK Retail Inflation Report summary

January 2024

Period covered: Period covered: December 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

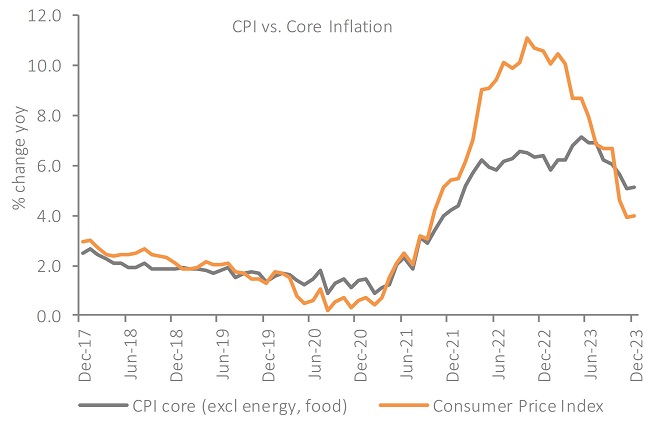

Inflation

Annual inflation edged higher in December, to xx% from xx% last month – the second lowest rate since September 2021. The rise was above economists forecasts of fall to xx%. On a monthly basis, prices rose by 0.4%.

The closely-watched services inflation rate edged up to xx (from xx% in December), also above expectations. Notably, this is still below the recent projections by the Bank of England however, it weighs on the prospect that interest rates will rise sooner rather than later. Goods inflation fell to xx% (from xx%).

The first rise in the headline inflation rate since February 2023 was driven by increases in tobacco duties, announced in the autumn statement, which resulted in prices rises. There was also a smaller upward contribution from alcohol.

Elsewhere, upward pressure came from categories which typically display volatile movements in prices such as airfares and computer games, which drove the uplift in the services inflation rate.

There was more positive news from the food category, with food inflation reporting another sharp drop, rising by 8.0% YoY, from 9.1% in November – the lowest rate since April 2022. Downward pressure came from milk, cheese and eggs, meat, fish, and sugar and jam. A partially offsetting upward effect came from breads and cereals.

However, overall food and non-alcoholic beverages inflation remains almost 26% over the two years between December 2021 and December 2023. This compares with a rise of around 9% over the ten years leading up to December 2021.

On the supply side, input producer price inflation remained in negative territory falling by 2.8% YoY (from 2.7% last month) but factory gate inflation edged into positive territory, albeit up just 0.1% as metal prices rose.

Looking ahead, the recent attacks on shipping vessels in the Red Sea could provide upward pressure to inflation next month.

Take out a FREE 30 day membership trial to read the full report.

Inflation edge up in December

Source: ONS

Source: ONS