Report Summary

July 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Economic activity

Quarterly GDP is estimated to have increased by xx% in Q2 2023 (Apr to June), following xx% growth in Q1 2023.

On a monthly basis, GDP rose xx% in June, following a fall of xx% in May and growth of xx% in April.

Services output rose by xx% in Q2 2023, the same as in Q1 2023 (xx%). On a monthly basis, Services rose xx% in June.

Confidence

GfK’s Consumer Confidence Index increased five points in August to xx

The Major Purchase Index increased eight points to xx. This is 14 points higher than the same month a year ago.

Expectations for the general economic situation over the coming 12 months increased by three points to xx. This is 30 points higher than the same month a year ago.

Inflation

Headline inflation eased again in July, rising by xx% YoY from xx% last month – a xx-month low but slightly ahead of economists’ expectations.

However, core inflation, excluding food and energy prices, was stickier, remaining unchanged at xx% for the second consecutive month, above economists' expectations of it dipping to xx%.

Credit and Housing Market

The latest data shows that the housing market continues to…

Take out a FREE 30 day membership trial to read the full report.

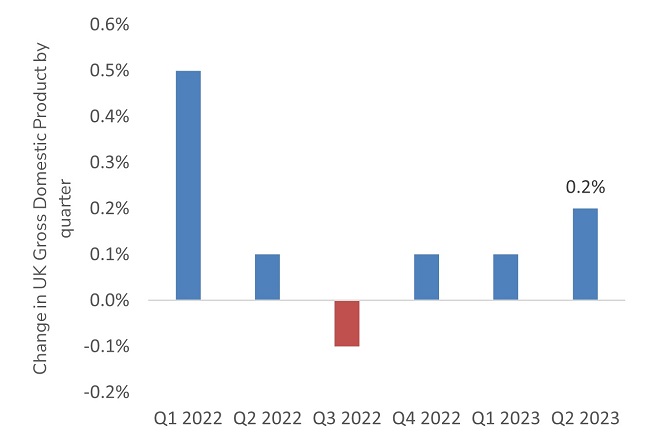

Quarterly GDP is estimated to have increased by 0.2% in Q2 2023 (Apr to June).

Source: ONS

Source: ONS