Bank of England Mortgage Approvals and Lending August 2019

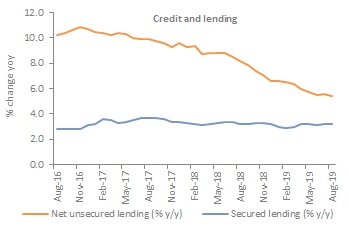

Activity in mortgage markets slowed in August, following a strong rise in July, according to the latest Bank of England figures. Indeed, the monthly change in the additional amount households borrowed slipped to £3.9bn, with the annual growth rate of secured lending remaining at 3.2%.

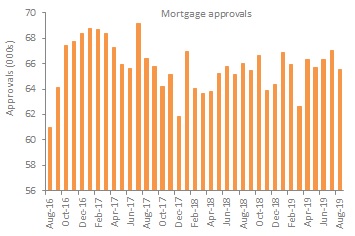

Mortgage approvals fell to 65,545 in August, down from 67,011, which is marginally below the previous six-month average of 65,626. On an annual basis, approvals fell 0.9%.

The number of re-mortgaging approvals rose, to 48,515 from 47,620 in the previous month. This was above the previous six-month average of 48,346.

Source Bank of England

Meanwhile, the additional amount borrowed in net lending to individuals fell back to £4.8bn in August, although was ahead of the previous six-month average of £4.7bn, while the annual growth rate remained at 3.5%.

Growth in unsecured lending to individuals continued to slow, rising just 5.4% year-on-year. The actual change in consumer credit dipped to £0.9bn slightly below the previous six-month average at £1.0bn.

Borrowing on credit cards slowed to 4.9% year-on-year, from 5.2% in July. The actual change in the amount borrowed weakened to £0.2bn, the lowest rate since December 2018 while the amount borrowed for the other loans and advances component was unchanged at £0.7bn in August.

Source Bank of England

Back to Retail Economic News