GDP Monthly Estimate: August 2021

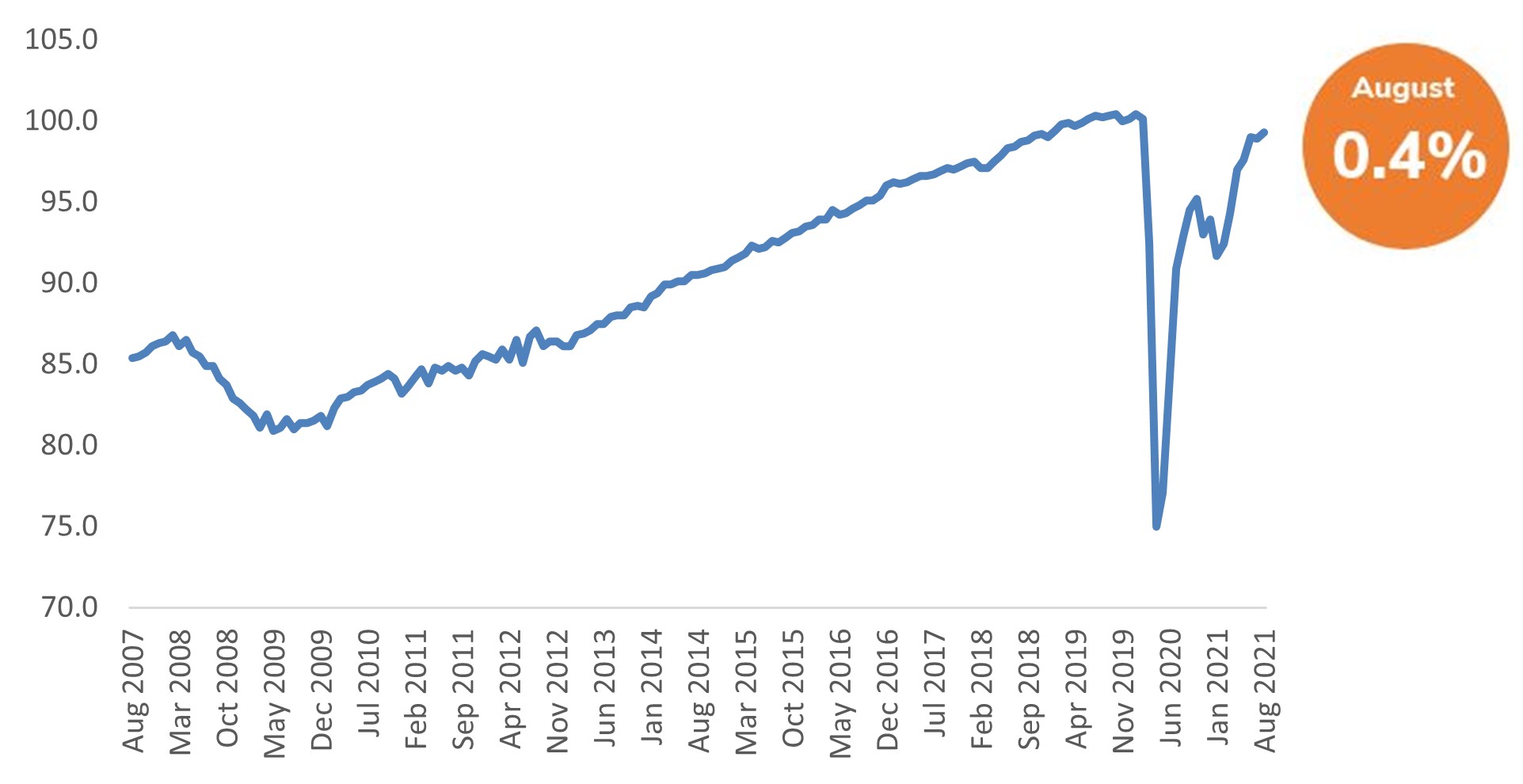

- Gross domestic product (GDP) is estimated to have grown by 0.4% in August, regaining momentum following an unexpected 0.1% fall in July. The economy is now 0.8% below February 2020’s pre-pandemic levels.

- Accommodation and food service activities were the key drivers of growth as many people turned to staycations due to ongoing restrictions on overseas travel.

UK GDP is estimated to have grown by 0.4% in August, and remains 0.8% below its pre-pandemic level

Monthly GDP index, January 2007 until August 2021, 2019 = 100. Source: ONS

Services

Services output grew by 0.3% in August, following a disappointing performance in July (-0.1%). The sector remains 0.6% below pre-pandemic levels.

Consumer-facing services rose by 1.2% in August, but remain 4.7% below pre-pandemic levels, compared to other services which have broadly recovered, at 0.4% above.

Accommodation and food services was the main contributor to services growth in August, increasing by 10.3%. There was particularly strong growth in accommodation (+22.9%), as staycations boosted bookings at hotels and campsites. In comparison, food and beverage services grew by 5.9%.

Arts, entertainment and recreation was another key contributor, rising by 8.5% in August. Cinemas, theatres, and nightclubs were able to operate at full capacity in August - the first full month of Covid-19 restrictions being lifted in England.

Partially offsetting services growth was a 4.0% fall in human health and social work activities in August, as GP appointments fell, alongside a reduction in test and trace activity and vaccination numbers.

Elsewhere, there was a 0.9% fall in retail trade and a 1.9% fall in the wholesale and retail trade and repair of motor vehicles. Air transport picked up as travel restrictions eased, rising by 27.5% in August, but remains 75.0% below its pre-pandemic level.

Overall, services output grew by 3.7% on a three-month rolling basis in August.

Construction

The construction sector contracted for the second consecutive month in August (-0.2%), reflecting rising raw material costs and delays in the availability of products (steel, concrete, timber, glass).

Construction output recovered to return above its pre-pandemic level back in April, but has since dropped back, and in August was 1.5% below that level.

The fall in construction output was attributed to a drop in repair and maintenance activity (-0.6%), with new work broadly flat.

The industry faces rising costs from suppliers. In August, approximately one in two construction businesses said prices of goods or services bought have increased more than normal, compared with one in four in March 2021.

Overall, in the three months to August, construction output fell by 1.3%.

Production

Production output rose by 0.8% in August, following 0.3% growth in July.

The largest contributor to the increase was from mining and quarrying (+16.0%), reflecting the reopening of oil field production sites that had been temporarily closed for planned maintenance. Despite output in the extraction of crude petroleum and natural gas expanding to levels last seen in December 2020, they remain low by historical standards, with August output 16.3% below its August 2019 level.

The Manufacturing sector grew by 0.5% in August, following a downwardly revised 0.6% fall in July. Most of the contribution to manufacturing growth resulted from a 6.6% increase in the manufacture of motor vehicles, as car production continues to recover following supply side challenges caused by a global microchip shortage. However, output in the manufacture of motor vehicles remains 14.5% below its February 2021 peak.

Overall, in the three months to August, production output rose by 0.3%.

GDP Sector Breakdown

Source: ONS

Back to Retail Economic News