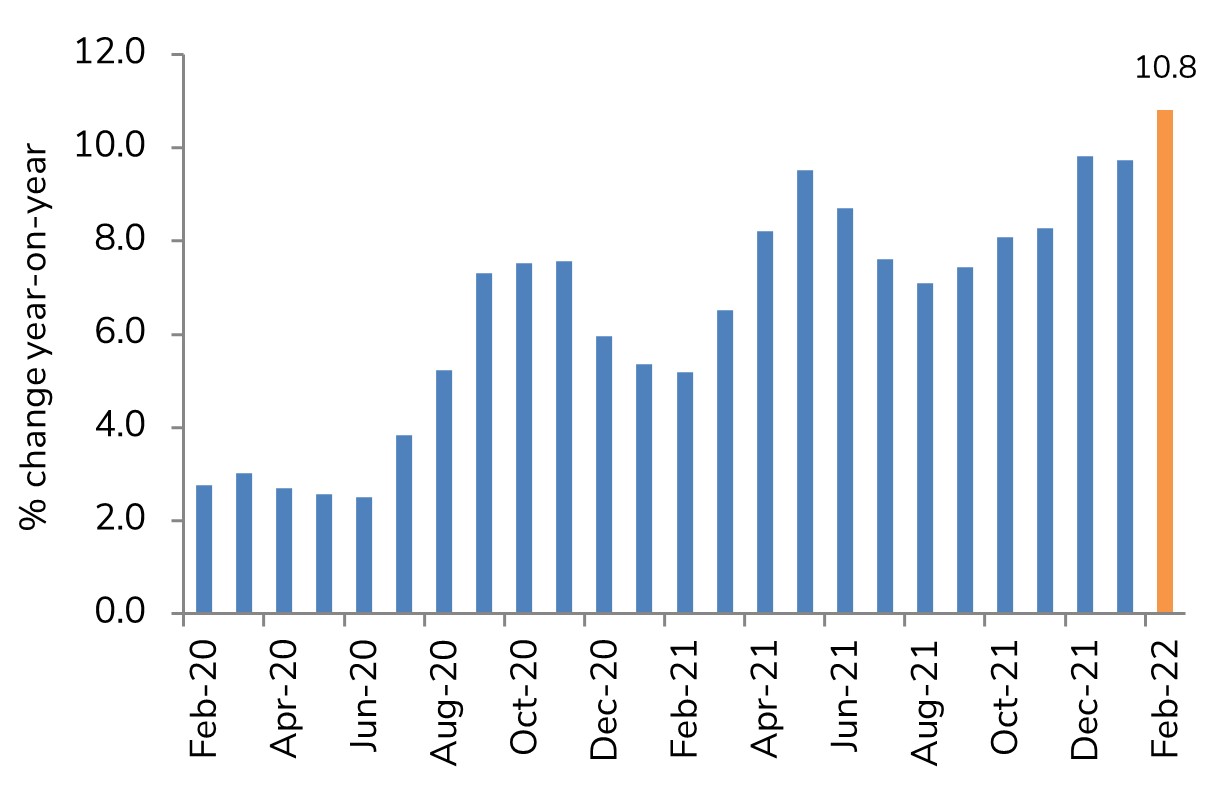

Halifax House Price Index February 2022

- UK house prices rose 10.8% YoY in February according to mortgage lender Halifax.

- This is the strongest annual rate of growth since June 2007 (+11.9%)

- Average UK house price reaches another new record high of £278,123

February saw strongest annual growth in house prices since 2007

Source: Halifax, IHS Markit

Key trends

- February was the eighth successive month of UK house price growth, as the resilience which has typified the market throughout the pandemic shows little sign of easing.

- Two years on from the start of the pandemic, average property values have now risen by £38,709 (+16%) since February 2020.

- Lack of supply continues to underpin rising house prices, with industry surveys showing a dearth of new properties being listed.

- Demand also remains robust, with mortgage approvals continuing to run above pre-pandemic levels as consumers re-evaluate their living arrangements.

Outlook

- While the limited supply of new housing stock to the market will continue to provide support to house prices, housing market activity is expected to return to more normal levels as 2022 progresses.

- Inflation, already at a 30-year high, is expected to rise above 7.0% in April, squeezing household spending power. Events in Ukraine add to the likelihood of inflation remaining higher for longer as energy prices surge.

- The Bank of England is also expected to raise interest rates to curb inflation, which will exert a further drag on the market as borrowing costs increase.

- Housing affordability has already become more stretched, with house price growth outstripping wage growth by a wide margin since the pandemic struck. The price of a typical home is now equivalent to 6.7 times average earnings, up from 5.8 in 2019.

Back to Retail Economic News