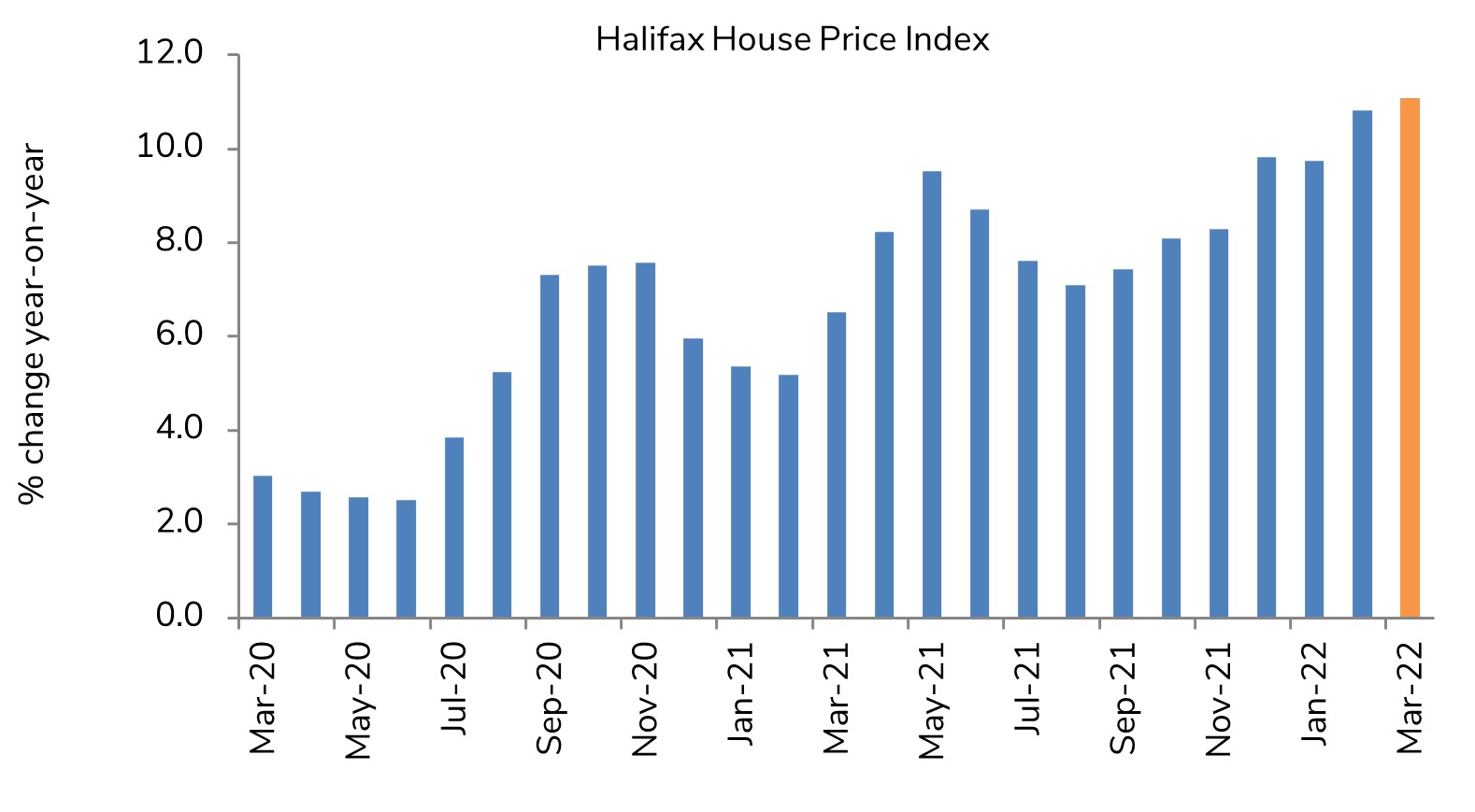

Halifax House Price Index March 2022

- UK house prices rose 11.0% YoY in March according to mortgage lender Halifax.

- Average UK house price reaches another new record high of £282,753.

- Two years on from the first lockdown, house prices have risen by £43,577.

House prices continue to rise steeply

Source: Halifax, IHS Markit

Key trends

- With 2021’s strong momentum continuing into the beginning of this year, the annual rate of house price inflation (+11.0%) continues to track around its highest level since mid-2007.

- A combination of robust demand and limited stock of homes on the market has kept upward pressure on prices. Although there is some recent evidence of more homes coming onto the market, the fundamental issue remains that too many buyers are chasing too few properties.

- March 2022 marked two years since the UK first entered lockdown. The average house price has risen by 18.2% over that period, or £43,577 in cash terms. This has taken the national average house price from £239,176 in March 2020 to £282,753.

- The impact of the pandemic on buyer demand can be seen most clearly when looking at different property types. With a premium now put on those properties offering greater space – both indoors and out – prices for detached properties have leapt 21.3% over the last two years, compared to just 10.6% for flats.

Outlook

- The housing market has retained a surprising amount of momentum given the mounting pressure on household budgets and the steady rise in borrowing costs.

- The continued buoyancy of housing demand may in part be explained by strong labour market conditions, while significant savings accrued during lockdowns is also likely to have helped prospective homebuyers raise a deposit.

- However the housing market is still expected to slow in the quarters ahead as the cost of living crisis intensifies. Inflation, already at a 30-year high, is expected to reach close to double digits later in the year, squeezing household spending power.

- If labour market conditions remain strong, the Bank of England are also likely to raise interest rates further, which will also exert a drag on the market through higher mortgage rates.

Back to Retail Economic News