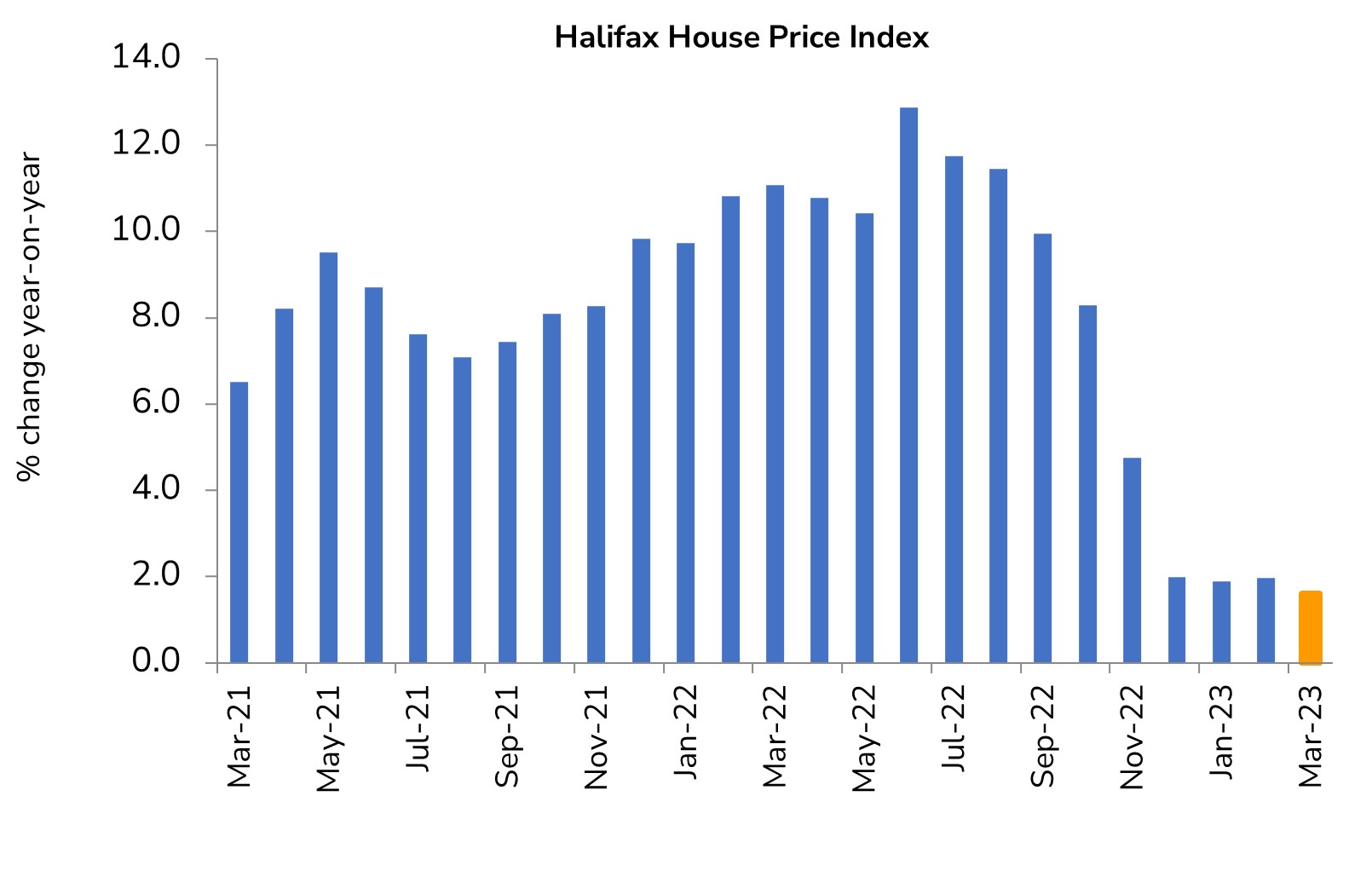

Halifax House Price Index March 2023

- UK house prices increased 1.6% YoY in March according to mortgage lender Halifax.

- Most areas of the UK saw the rate of annual growth slow in March.

- Average UK property now costs £287,880 (up from £285,660 in February).

Annual rate of growth weakest since October 2019

Source: Halifax, IHS Markit

Key Trends

- The annual rate of house price growth was 1.6%, the weakest annual rate of growth since October 2019.

- House prices increased 0.8% on a monthly basis in March, following a 1.2% monthly increase in February.

- Annual growth was strongest in Northern Ireland at 4.9%, followed by the West Midlands (3.8%).

- In Wales and Scotland, the annual rate of price growth slowed to 1.0% and 2.3% respectively.

- London saw average house prices rise 0.1% YoY, with the average property in the region now worth £537,250.

Outlook

- March saw UK house prices stabilise further, driven primarily by the easing of mortgage rates, with recent Bank of England data showing mortgage approvals rising for the first time in six months.

- Although rates remain high, a typical five-year fixed rate deal (75% LTV) has fallen by more than 100 basis points in the last few months.

- Resilience in the housing market has also been bolstered by a robust labour market, with unemployment remaining low at 3.7% and earnings growth remaining strong.

- While living costs will remain high in the near-term, buyer confidence should increase later in the year as inflation eases.

- But, despite mortgage rates easing, borrowing costs will remain significantly higher than the average of the last ten years, and will therefore continue to put downward pressure on housing market activity.

Back to Retail Economic News