Navigating Rising Interest Rates: Impacts on Homeowners and Renters

This article is derived from our report 'Retail and Leisure Outlook 2023' in partnership with Natwest, which explores the outlook for retail and retail related industries throughout 2023, with key trends and strategies to stay ahead.

5 minute read

Interest rates are on the rise, and this is causing concern among those planning to remortgage in the coming year and beyond. After a decade of ultra-low rates, the prospect of higher interest rates is becoming a reality. In fact, a recent survey revealed that a net balance of 44% of mortgage holders are worried about interest rate hikes in 2023, compared to only 26.1% of homeowners without mortgages. Let's delve deeper into the implications and explore how this affects both homeowners and renters.

Please remember this article contains only a small amount of the content contained in the report, download the report for even more insights!

Implications for Homeowners –

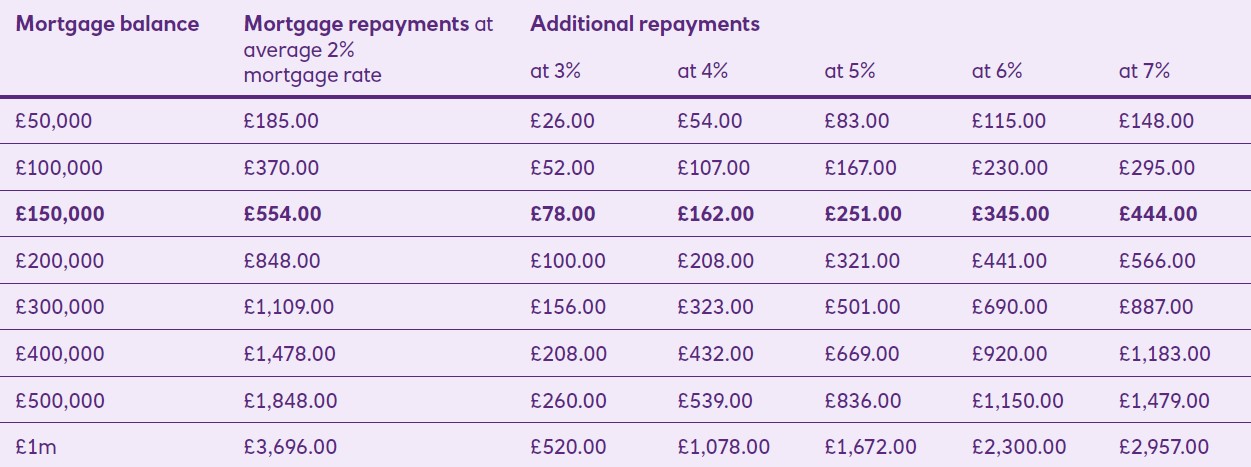

Over two million households are set to remortgage in 2023, and approximately 80% of them have been enjoying rates as low as 2.5% or even lower. However, with the average two and five-year fixed rate reaching 6% by the end of 2022, these homeowners now face the challenge of renewing their mortgage at a significantly higher rate. To put it into perspective, let's consider an average mortgage balance of £150,000 on a 30-year term. With a 6% interest rate, homeowners in this situation would need to pay an additional £345 per month. Collectively, this amounts to a staggering £8.3 billion in annual payments for the two million households impacted.

Mortgage sensitivity: 6% rate mortgage holders would pay extra £8.3bn in

payments per year on £150,000 balance.

Source: Retail Economics 2023

Impact on Renters –

It's not just homeowners who are feeling the pressure; renters are also affected as landlords pass on the increased housing costs. At the close of 2022, rental prices experienced the highest growth rate in six years, standing at 4% (ONS). Renters, who typically spend a larger portion of their income on accommodation, find their discretionary spending power at greater risk due to rising rental values. On average, renters spend £106.50 per week on rent, accounting for housing benefits and allowances, which is equivalent to 24% of their median weekly expenditure (ONS). In contrast, homeowners spend an average of 16% of their median weekly expenditure on mortgage repayments.

Impact on spending -

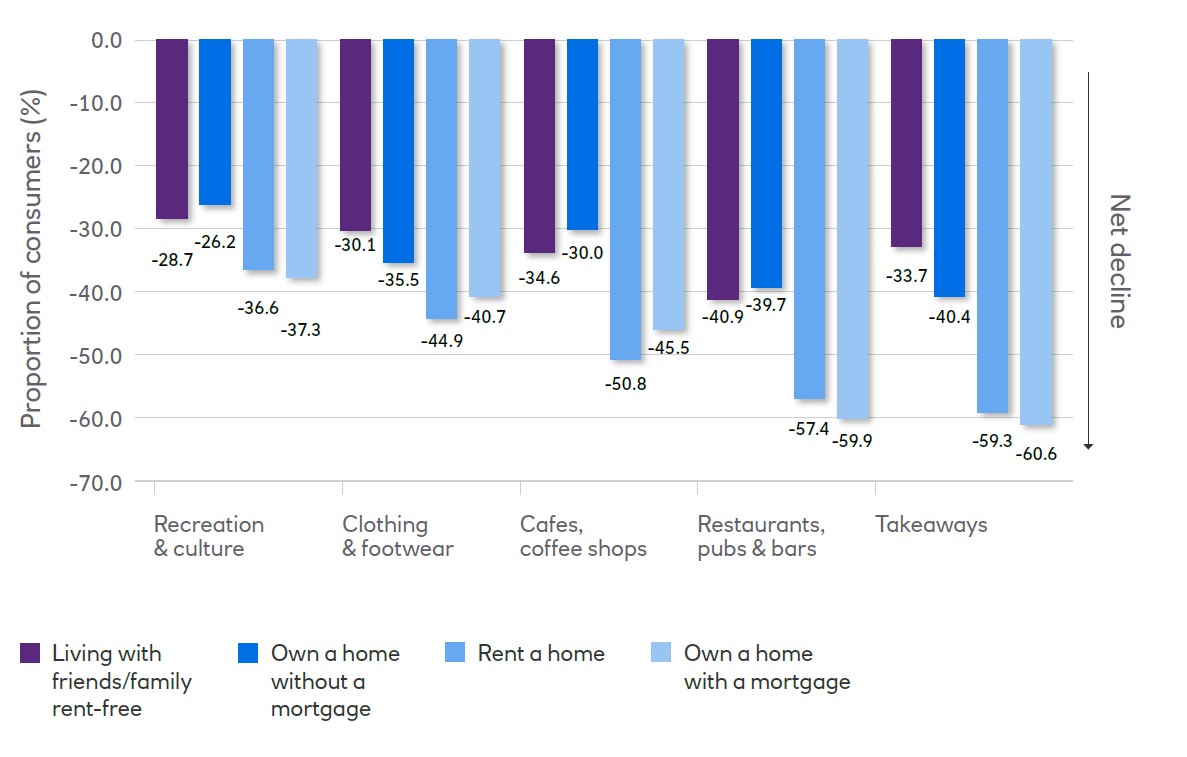

The rising housing costs directly impact disposable income and weaken spending intentions. Both homeowners and renters are likely to cut back on their expenses, leading to downward pressure on spending, particularly for mid-market brands. Interestingly, a higher percentage of mortgage holders (58.3%) fall into the middle-to-high and high-affluence category, compared to renters (50.7%) who are predominantly low-to-middle and low-affluent consumers.

Q: Likelihood to change in quantity bought over the next 12 months?

Source: Retail Economics 2023

As interest rates continue to rise, the implications for both homeowners and renters become more apparent. Homeowners face the challenge of renewing their mortgages at higher rates, leading to increased monthly payments. Renters, on the other hand, experience the strain of landlords passing on higher housing costs, limiting their discretionary spending power. With both groups likely to cut back on expenses, businesses, especially mid-market brands, need to be prepared for a potential decrease in consumer spending.