ONS Labour Market April 2022

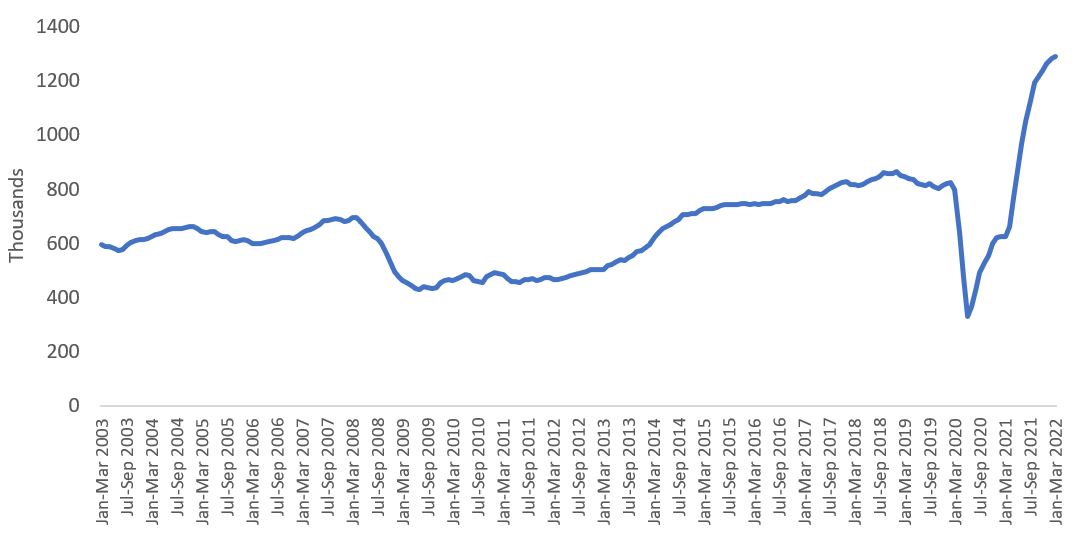

Vacancies keep rising

- The number of Job vacancies reached another record high of 1,288,000 in the three months to March 2022. This marked an increase of 492,400 from pre-pandemic levels (Jan-Mar 2020).

- However, the rate of growth in vacancies slowed for the eighth consecutive period, rising 4.1%, the lowest since June to August 2020.

- By industry, the largest increase in vacancies came from human health and social work (13,100).

Payrolled employees at record high

- Early payroll estimates for March show the number of payrolled employees rose by 4.9% year-on-year to 29.6 million. This is up 544,000 on the pre-Covid level, with the number of payrolled employees up by 1.9% since February 2020.

- All age groups saw an increase in payrolled employees between March 2021 and March 2022; there was an increase of 585,000 payrolled employees aged under 25 years.

- The largest yearly increase in payrolled employees continued to be in accommodation and food services (+374,000 employees) and smallest in the finance and insurance sector (+1,000).

Number of vacancies in the UK, seasonally adjusted, January to March 2003 to January to March 2022

Source: Office for National Statistics

Near-record low unemployment

- The latest unemployment estimates show a 0.2pp drop on the previous three-month period to 3.8%, this was 0.1pp below pre-pandemic levels.

- Compared to the previous quarter, the economic inactivity rate increased by 0.2 percentage points to 21.4%.

- During the last three-month period, there was a decrease in the inactivity rate for young people (those aged 16 to 24 years).

Employment rate flat

- The employment rate was largely unchanged at 75.5%, 1.1 percentage points (pp) down on pre-pandemic levels.

- The number of full-time employees increased on the quarter; however this was offset by a decrease in part-time employees.

Rise in hours worked

- In the three months to February, total actual weekly hours worked increased by 18.8 million hours compared with the previous three-month period to 1.04 billion hours.

- This is still 14.6 million hours below pre-coronavirus levels (December 2019 to February 2020).

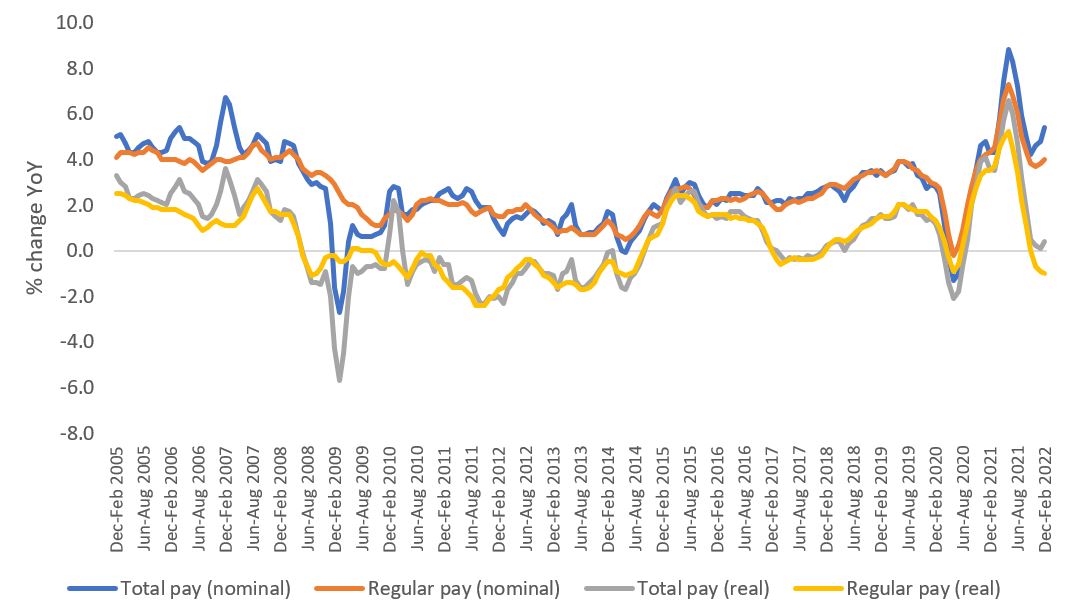

Inflation outpaces earnings

Annual pay edged higher in the three months to February but remains below inflation.

- In nominal terms, average regular pay (excluding bonuses) for employees in Great Britain was £556 per week before tax and other deductions from pay – up from £535 per week a year earlier.

- Average total pay (including bonuses) for employees in Great Britain was £598 per week before tax and other deductions from pay – up from £567 per week a year earlier.

- Regular and total pay growth rose by 4.0% and 5.4% respectively in the three months to February compared to a year earlier.

- In real terms (adjusted for inflation), total pay rose just 0.4% in the three months to February, while regular pay declined 1.0% over the period.

Average weekly earnings annual growth rates in Great Britain, seasonally adjusted, February 2005 to February 2022

Source: ONS

Back to Retail Economic News