ONS Labour Market June 2021

Unemployment, employment and job vacancies continue to recover as restrictions eased in April according to the latest ONS data.

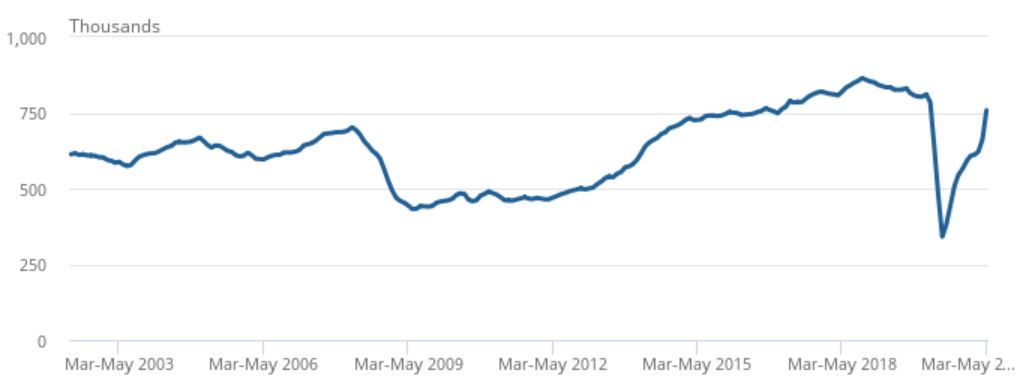

Job openings jump

- The reopening of non-essential shops and outdoor hospitality has seen businesses look to hire staff to cope with demand.

- Between March and May, the number of vacancies was just 27,000 below pre-pandemic levels (the quarter to March 2020) at 758,000, as most industries recovered with vacancies above pre-pandemic levels.

- The strongest quarterly rise was in accommodation and food services, up more than 260% on the quarter to May – with experimental monthly data from Adzuna for May showing vacancies for both surpassed pre-pandemic levels.

Number of vacancies in the UK, seasonally adjusted, March 2002 to May 2002 to March 2021 to May 2021

Source: ONS

Employment rises as unemployment dips

- Early payroll estimates for the quarter to May show the number of payroll employees increased for a sixth consecutive month, rising by 141,000 employees – or 0.5% – on last year.

- However it remains some 553,000 below pre-pandemic levels – with those aged under 25 years, working in hospitality, and living in London most impacted.

- For instance, by age, there was a 126,000 decrease in payrolled employees aged younger than 25 years between May 2020 and May 2021. During the same period, payrolled employees aged 50 to 64 years experienced an increase of 181,000 employees.

- The UK employment rate was estimated at 75.2% in the three months to April, which is 0.2 percentage points higher than the previous quarter.

- It should be noted that one in 10 workers – some 2.7 million people – were on furlough leave in the two weeks to mid-May who count as employed, including up to a fifth of the hospitality workforce.

- The latest unemployment estimates show a 0.3 percentage point drop on the previous quarter to 4.7% in the three months to April.

Hours worked rise

- As restrictions eased in the three months to April, total actual weekly hours worked increased by 7.2 million hours from the previous quarter to 975.2 million hours.

- However, this is still 77.0 million hours below pre-pandemic levels (December 2019 to February 2020).

Earnings step up

Annual growth in average employee pay continued – driven in part by compositional effects from a fall in the number and proportion of lower-paid jobs.

- The ONS estimates the net impact of recent job losses accounts for approximately 1.5% of average pay growth.

- Pay growth is further being affected by a weak base effect from annual comparisons. The latest month is now compared with April 2020, when earnings were first affected by the pandemic.

For April in nominal terms:

- Average regular pay (excluding bonuses) for employees in Great Britain was £539 per week before tax and other deductions from pay – up from £502 per week a year earlier.

- Average total pay (including bonuses) for employees in Great Britain was £571 per week before tax and other deductions from pay – up from £527 per week a year earlier.

- Total and regular pay growth rose 8.4% and 7.3% in April compared to a year earlier.

Great Britain, AWE annual growth rates, February to April 2021

Source: ONS

Back to Retail Economic News