ONS Labour Market October 2020

The latest ONS labour market data shows little change in the number of PAYE employees on the previous month, while the unemployment rate and level of redundancies increased.

It should be noted that the ONS have made some methodological changes this month to account for the impact of the coronavirus pandemic.

673,000 fewer on PAYE since March

- The number of paid employees was down by some 673,000 in September compared with March 2020 according to flash estimates using PAYE data – around 20,000 lower than in August.

- Total hours worked showed further signs of recovery in the three months to August 2020, recording a record rise of 20.0 million hours on the quarter to 891.0 million.

UK total actual weekly hours worked (people aged 16 years and over), seasonally adjusted, between June to August 2005 and June to August 2020

Source: ONS

Further recovery in vacancies

- The number of job vacancies recovered further in the three months to September, rising by a record 144,000 to 488,000 from the record low in April to June 2020, driven by small businesses.

- However, vacancies remain some 40.5% lower than a year ago, equating to 332,000 fewer positions.

Employment rate slows

- The employment rate slowed to 75.6% in the three months to August, which was 0.3 percentage points down on the quarter and 0.3 percentage points lower than a year earlier. This equates to 32.59 million people aged 16 years and over in employment, which is 102,000 fewer than a year earlier.

- A closer look at the figures suggests a disparity by age continues. Those aged 25 to 64 years old saw an increase of 92,000 on the quarter to 27.77 million, driven by women in employment reaching a record high rate of 3.61 million.

- Concerningly, those aged 16 to 24 years saw employment decrease by 220,000 to a record low of 3.54 million, with a record decrease of 191,000 for those aged 18 to 24 years.

- The unemployment rate in the quarter to August was 4.5% - the highest rate in over three years and ahead of the consensus view of the rate rising to 4.3%. This is 0.6 percentage points higher than a year earlier and 0.4 percentage points higher than the previous quarter, equating to a rise of 138,000 people – the largest quarterly increase since July 2009.

- The ONS’s experimental claimant count data shows the Claimant Count increased by 1.0% to 2.7 million in September 2020. Since March, the claimant count has increased by 120.3%, or 1.5 million.

- Meanwhile, redundancies increased by 113,000 on the year, the largest increase since June 2009 while on the quarter they increased by a record 114,000 to 227,000, the highest level seen July 2009.

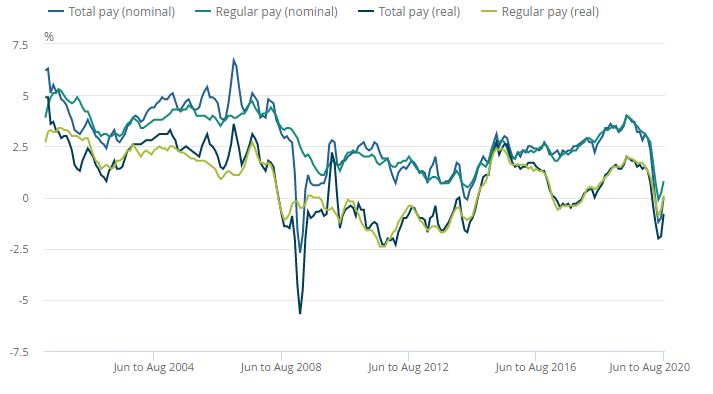

Annual pay growth strengthenss

- Annual pay growth on a total basis (including bonuses) was unchanged in the three months to August, as bonuses fell by an average of 15.3% in the period.

For the three months to August:

- total pay (including bonuses) was unchanged

- regular pay (excluding bonuses) increased by 0.8%

Adjusted for inflation:

- total real pay fell by 0.8%

- regular real pay rose by 0.1%

For August in nominal terms (that is, not adjusted for price inflation):

- average regular pay (excluding bonuses) for employees in Great Britain was £517 per week before tax and other deductions from pay – down from £508 per week a year earlier

- average total pay (including bonuses) for employees in Great Britain was £550 per week before tax and other deductions from pay – down from £540 per week a year earlier

Great Britain average weekly earnings annual growth rates, seasonally adjusted, January to March 2001 to June to August 2020

Source: ONS

Back to Retail Economic News