ONS Labour Market October 2024

Payrolled Employees

- Decreased by 15,000 (0.0%) in September but increased by 113,000 (0.4%) YoY, reaching 30.3 million.

- From June to August, payrolled employees rose by 3,000 (0.0%) on the quarter and by 203,000 (0.7%) YoY.

Employment and Unemployment Rates

- The UK employment rate (16-64 years) stood at 75.0% in June to August, up from the previous quarter and a year ago.

- The UK unemployment rate (16+ years) fell to 4.0% in June to August, lower than a year ago and the previous quarter.

Economic Inactivity and Claimant Count

- The UK economic inactivity rate (16-64 years) stood at 21.8% in June to August, lower than both the previous quarter and a year ago.

- The UK Claimant Count for September increased on the month and year, rising to 1.797 million, influenced by administrative changes affecting 180,000 claimants.

Vacancies

- Estimated vacancies fell by 34,000 from July to September 2024, marking the 27th consecutive quarter of decline, with total vacancies at 841,000, still above pre-pandemic levels.

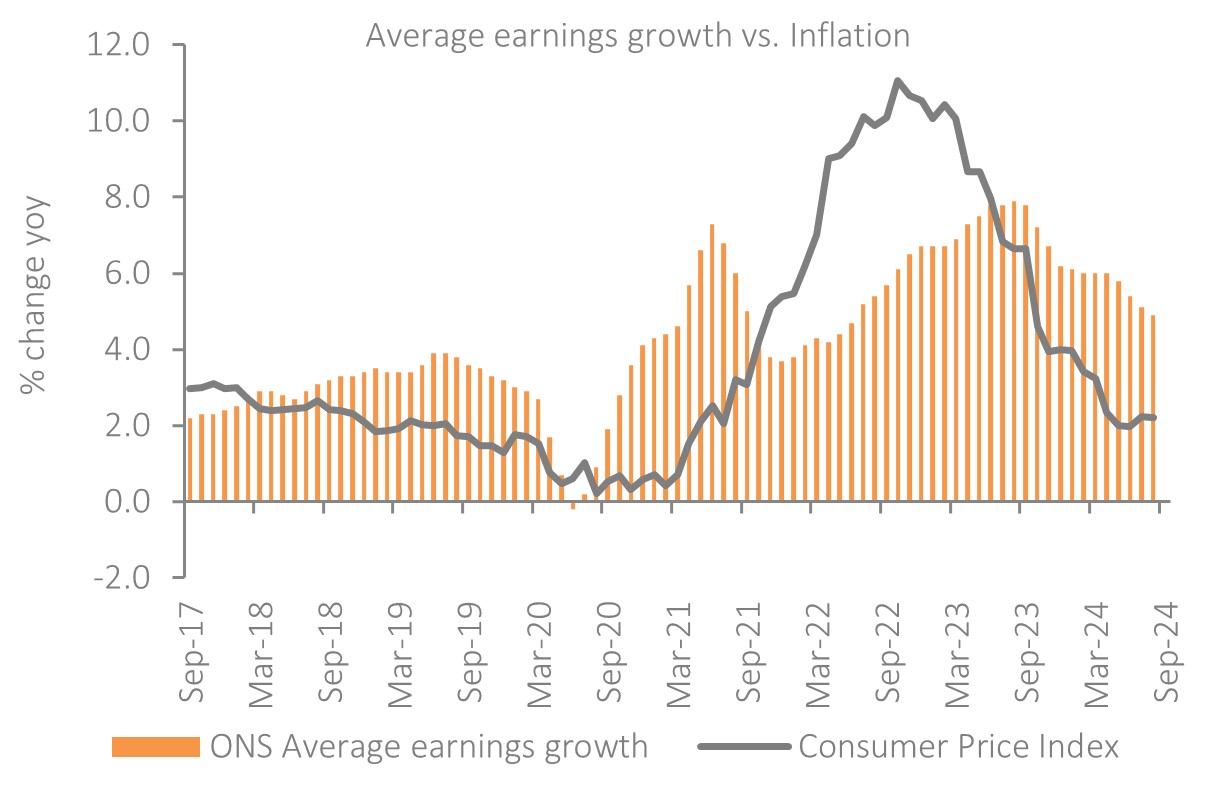

Earnings Growth

- Annual growth in regular earnings (excluding bonuses) was 4.9% in June to August 2024. This was the first time earnings have fallen below 5% in more than two years.

- Total earnings (including bonuses) grew by 3.8% annually, driven by one-off public sector payments made in 2023.

- Real terms annual growth (adjusted for CPIH inflation) for regular pay was 1.9%, and total pay grew by 0.9%.

Labour Disputes

- 31,000 working days were lost due to labour disputes across the UK in August 2024.

Easing wage growth narrows gap to inflation

Source: ONS

Back to Retail Economic News