ONS Retail Sales December 2021

- Retail sales (value, non-seasonally adjusted, exc. fuel) rose by 5.3% year-on-year (YoY) in December, against a decline of 0.2% last year according to the latest ONS data.

- In volume terms, retail sales declined by 3.0% in December on the previous year (seasonally adjusted, exc. fuel), and dropped 3.6% compared to November.

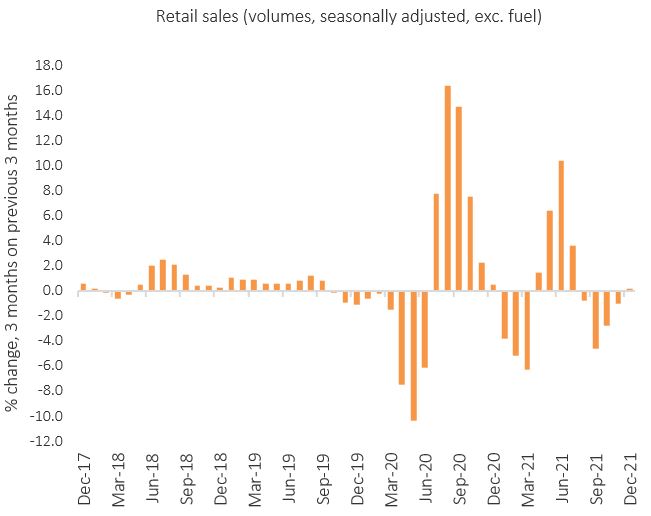

- Across the critical golden quarter period, the three-month-on-three-month growth rate edged up just 0.2% in the quarter to December (volume, seasonally adjusted).

Retail sales (volume, seasonally adjusted) – 3-months on previous 3-months

Source: ONS

Food and non-food

- Food store sales rose at its strongest rate since February at 4.6% YoY in December (value, non-seasonally adjusted). This came against a soft 0.6% comparative.

- Clothing continued to climb on last year in December, but dipped below levels seen two years ago. Clothing sales increased by 13.2% YoY compared to a 17.7% decline last year (value, non-seasonally adjusted, all businesses).

- Robust comparatives saw Household Goods record broadly flat growth at 0.3% YoY in December, but remain ahead of 2019 levels.

- Meanwhile Furniture and Lighting store sales declined by 4.5% YoY in December (+1.6% in December 2020), and were down on 2019 levels amid stock challenges.

- But against weak comparatives, Floor Covering sales doubled at 102.7% growth in December, compared to sales plummeting 51.0% in December 2020 (value, non-seasonally adjusted).

Online

- Online sales (non-seasonally adjusted, excluding automotive fuel) declined by 6.9% YoY in December, against a strong 45.6% rise a year earlier when England faced tiered restrictions.

- The proportion of retail sales made online was 27.7% in December – down from 30.1% last month and 31.3% in December 2020.

Retail sales price deflator

- The retail sales deflator (a measure of inflation specific to retail) excluding fuel stepped up by 4.8% YoY in December – its fastest rate since August 2011. When including fuel, the sales deflator jumped by 6.2% against a 1.1% decrease last year.

- The implied price deflator among food stores rose by 4.5% YoY and rose by 4.9% among non-food stores.

Back to Retail Economic News