ONS Retail Sales February 2025

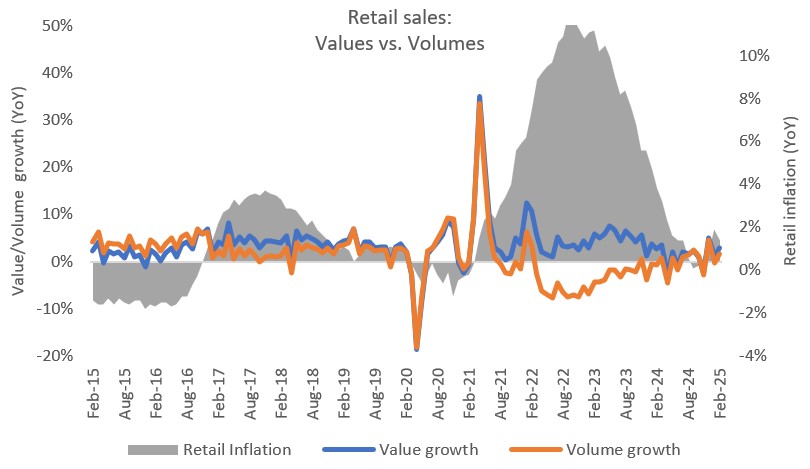

- Retail sales (value, non-seasonally adjusted, exc. fuel) rose by 2.8% year-on-year (YoY) in February according to the latest ONS data. It compares to a 2.7% rise a year earlier.

- In volume terms (non-seasonally adjusted, exc. fuel), retail sales rose by 1.7% YoY in February. It compares to a weak 0.7% decline a year ago.

- It should be noted that ONS figures are based on a sample of some 5,000 retailers and are subject to revisions.

Sales outpace expectations but remain weak

Source: ONS, Retail Economics analysis

Note: all retail sales figures provided below are non-seasonally adjusted, excluding Fuel, unless stated otherwise.

Food and non-food

- Food sales values edged up by just 0.8% YoY in February. This compares to a 4.3% rise a year earlier during higher levels of inflation. Adjusting for inflation, volume declines deepened to a 1.8% decline against a 0.9% fall in the previous year.

- Non-food sales rebounded in February, with both values and volumes rising by 4.0%.

- Clothing sales volumes inched up 0.4% on last year in February, following four months of decline, and follows a 6.6% decline a year earlier. Footwear and Leather Goods volumes declined by 5.3%.

- Household Goods volumes jumped 7.8% YoY, but sales remain down on pandemic and pre-pandemic levels. Electrical Household Appliances drove volume growth, up by 11.5% in February.

- Pharmaceuticals, Cosmetics and Toiletries volumes remained in decline in February, down by 4.7% despite Valentine’s Day gifting.

Online

- Online sales values edged up 3.2% YoY in February, against a 3.3% rise a year earlier.

- Household Goods declined 1.2% in February, while Clothing & Footwear sales edged up 0.4%.

- Non-store retailing (a proxy for pureplay retailers) rose by 2.2% YoY in the month, against a 4.1% rise a year earlier.

- The proportion of retail sales made online was 26.0% in February, down from 25.9% a year earlier.

- Overall, average weekly online sales were broadly flat on last year at £2.2bn in February.

Retail sales price deflator

- The retail sales deflator (a measure of inflation specific to retail) rose by 0.7% including fuel, and 1.0% when excluding fuel.

- The implied price deflator among food edged up to 2.7% in February, against a 5.3% rise in the previous year. Among non-food stores, the price deflator was broadly flat at 0.1%.

Back to Retail Economic News