ONS Retail Sales June 2022

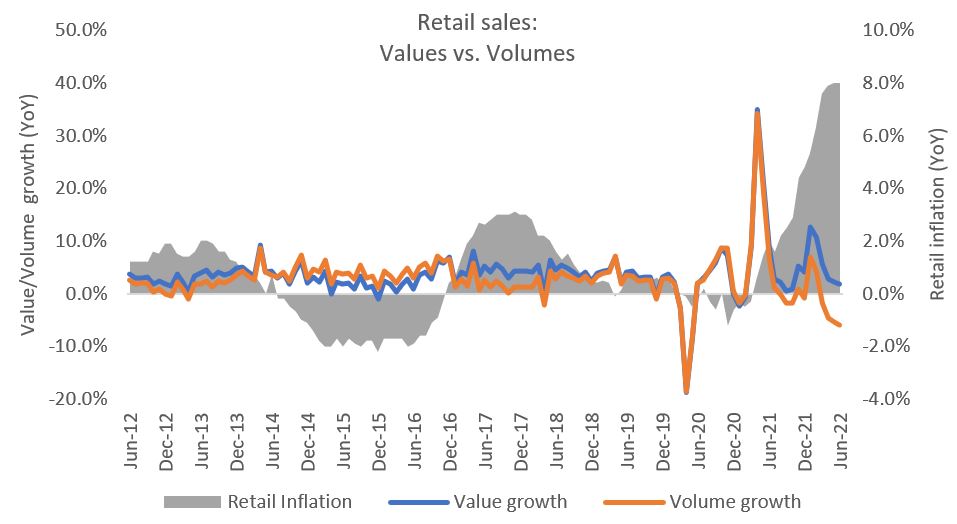

- Retail sales (value, non-seasonally adjusted, exc. fuel) rose by a soft 1.7% year-on-year (YoY) in June, against 8.6% growth a year earlier according to the latest ONS data.

- In volume terms, retail sales fell by 5.9% YoY in June, against a rise of 6.5% a year ago (non-seasonally adjusted, exc. fuel). It follows a 5.5% decline in May.

- Resultantly, the three-month-on-three-month volume rate edged down by 1.2% in the quarter to June (volume, seasonally adjusted).

Retail sales value and volume growth has detached

Source: ONS, Retail Economics analysis

Food and non-food

- Food store sales edged up by 2.4% in June on the back of Jubilee celebrations, compared to a 0.7% rise a year earlier (value, non-seasonally adjusted). Although food volumes increased in June compared to the previous month, they were down 5.9% on last year (volume, non-seasonally adjusted).

- Clothing sales recorded a further rise, up by 12.0% YoY in June despite a 41.1% surge in the previous year. Demand continued to be supported by a rise in shopping for holidays. Volumes rose by 4.6% YoY in the month.

- Furniture and Lighting stores sales grew by 4.3% YoY in June against a 28.6% rise a year earlier, supported by rising prices. Underlying volumes declines 8.1% YoY in the month.

- Household Goods sales declined 8.4% during the month, against 20.1% growth last year, as consumers look to cut back spending. After accounting for inflation, volumes declined by a deep 17.7% YoY in June.

Online

- Online declines deepened in June, with ecommerce sales down by 9.7% YoY compared with a 3.0% decline a year earlier (value, non-seasonally adjusted).

- All online categories recorded a decline, with Household Goods (-18.5%) and Food (-13.8%) seeing double-digit declines.

- The proportion of retail sales made online fell to 24.8% in June – the lowest penetration rate since 22.1% recorded in March 2020.

Retail sales price deflator

- The retail sales deflator (a measure of inflation specific to retail) remained at a record 8.0% YoY in June excluding fuel, and stepped up to 11.1% when including fuel amid record petrol and diesel prices.

- The implied price deflator among food stores surged by 8.8% YoY, but eased among non-food stores to 7.4% (from 8.7% last month).

Back to Retail Economic News