ONS Retail Sales June 2024

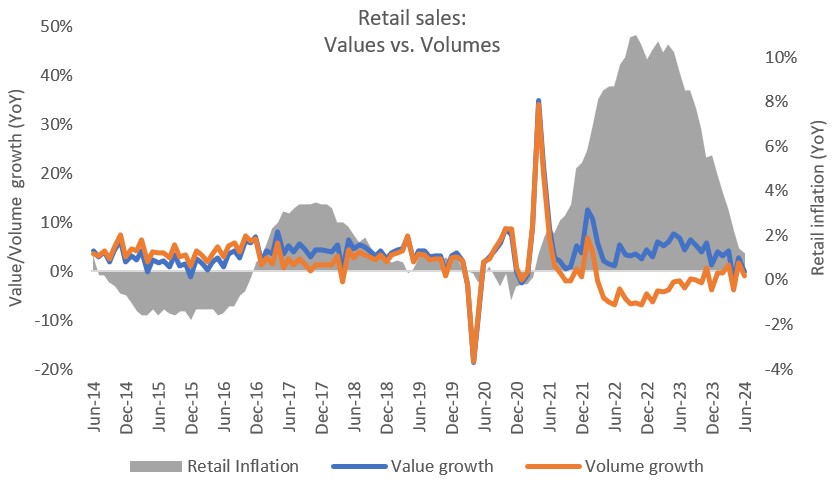

- Retail sales (value, non-seasonally adjusted, exc. fuel) were broadly flat in June, declining by 0.1% year-on-year (YoY) according to the latest ONS data. It compares to a 6.8% rise a year earlier.

- In volume terms (non-seasonally adjusted, exc. fuel), retail sales declined by 1.0% YoY in June following a 1.7% rise in the previous month. It compares to a weak 2.0% decline a year ago.

- It should be noted that ONS figures are based on a sample of some 5,000 retailers and are subject to revisions.

Values and volumes dip in June

Note: all retail sales figures provided below are non-seasonally adjusted, excluding Fuel, unless stated otherwise.

Food and non-food

- Food sales values declined by 1.1% YoY in June. This compares to a 9.9% rise a year earlier during periods of high inflation. Adjusting for inflation, volumes plunged by 3.2% in June against a 2.8% decline in the previous year.

- Non-food sales values declined by 1.1% in the month compared to a 4.7% rise in the previous year. In volume terms, non-food sales slipped back into decline at -1.0% in June against a 1.3% fall a year earlier.

- Within Non-food, sales came under pressure across most categories.

- Clothing sales values fell 4.3% in June, with volumes down 5.7%. Footwear and Leather Goods volumes fell back into decline at -1.5%, albeit against a strong comparison to last year when sales rocketed 27.0%.

- Sales volumes of Household Goods slipped further into decline in June, continuing more than two and a half years of decline. Volumes fell by 4.5% in June. Big ticket Furniture and Lighting volumes decreased by 12.4%, despite declining prices.

Online

- Online sales values rose by 1.9% YoY in June, against a 7.6% rise a year earlier.

- Household Goods suffered the deepest declines, with sales plummeting 18.0% against a strong comparison last year (17.5%), while Clothing & Footwear also dropped 5.5%.

- Non-store retailing (a proxy for pureplay retailers) rose by 4.7% YoY in the month, against a 5.1% increase a year earlier.

- The proportion of retail sales made online was 25.9% in June, up on 25.4% a year earlier.

- Overall, average weekly online sales were £2.28bn in June, up from £2.24bn in the previous year.

Retail sales price deflator

- The retail sales deflator (a measure of inflation specific to retail) rose by 0.8% YoY in June when excluding fuel – the weakest rate since April 2021 – and rose by 1.0% when including fuel.

- The implied price deflator among food stores rose by 2.1% in June, against a 13.1% rise in the previous year. Among non-food stores, the price deflator remained broadly flat at -0.1% – its softest level since February 2021.

Back to Retail Economic News