ONS Retail Sales October 2020

Retail sales (value, non-seasonally adjusted, excluding fuel) rose by a strong 8.4% in October according to the latest ONS data – the fastest rate since July 1990 (excluding Easter distortions).

Spending was brought forward as shoppers looked to shop early for Christmas amid discounting, while a national lockdown was impending at the end of the month.

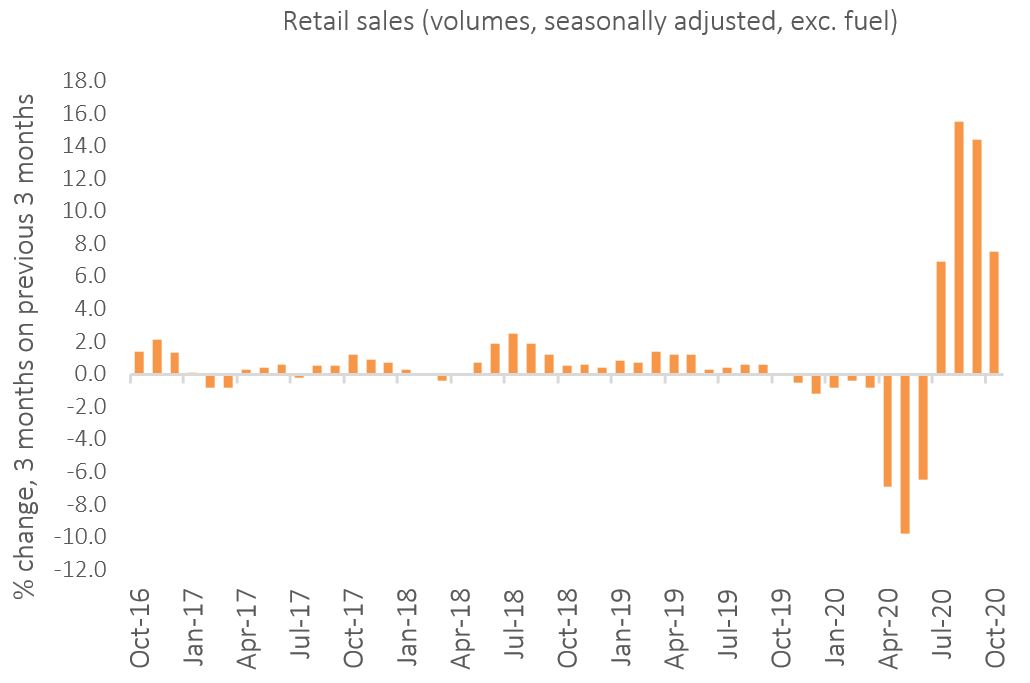

Retail sales (volume, seasonally adjusted) – 3-months on previous 3-months

Source: ONS

In volume terms (seasonally adjusted, excluding fuel), retail sales jumped by 7.8% in October on last year and by 1.3% on last month. The strength of retail in recent months has seen sales volumes rise by 7.5% when comparing the most recent three months to the previous three months.

October’s total retail sales values (excluding fuel) were 7.9% ahead of February’s pre-pandemic level, helped by a transference of spending benefiting home cooking and a focus on home improvement. But the ONS noted that clothing remains behind pre-pandemic sales.

As consumers spend more time at home, the recovery in retail continues to favour ecommerce. Online sales (non-seasonally adjusted, excluding automotive fuel) rocketed by 59.7% year-on-year in October – the fastest pace since June. Online sales accounted for 28.1% of total retail sales in October – well ahead of 19.1% a year earlier, but down from 32.8% in May.

The retail sales deflator (a measure of inflation specific to retail) excluding fuel was flat compared to last year, but down 0.9% when including fuel.

The implied price deflator among non-food stores was flat in October, while prices edged up 0.4% year-on-year among food stores.

Back to Retail Economic News