RICS Residential Market Survey August 2019

The latest RICS Residential Survey reported a weakening in sentiment, particularly on a near-term basis, as Brexit continues to weigh on the confidence of both buyers and sellers. Indeed, new buyer enquiries fell back to +3% in August after demonstrating an uplift in the previous two months.

Furthermore, the net balance of newly agreed sales fell further into negative territory in August, falling to -8% compared with -6% in July. Delving into the breakdown shows a fall or flat trend across most areas of the UK with only Wales and the North East of England seeing a rise over the month.

Interestingly, there was an improvement in the time taken to complete a sale which now stands at 18 weeks after residing at 19 weeks for much of the year.

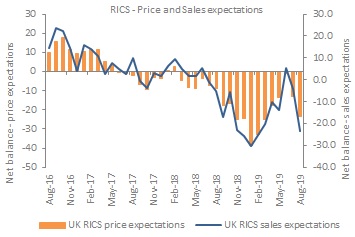

Further disappointing news was reported in the near-term sales expectations series which fell to -23% in August - the weakest result since February. That said, on a 12-month horizon a modest rise of +5% is expected.

Little change was seen in new instructions for the third consecutive month and, with the number of appraisals being undertaken reporting an annual decline, there is no suggestion of an improvement going forward.

The headline price indicator showed a slight improvement to -4% in August (from -9% in July) suggesting house prices were largely unchanged across the country.

Near-term price expectations fell deeper into deflationary terror with the net balance declining to -24% in the month, while the outlook for prices further out is significantly more positive at +12%.

Elsewhere, the lettings market saw tenant demand rise to +23%, the eighth consecutive month in positive territory. That said, landlord instructions remain in negative territory with the disparity between demand and supply expected to push rents higher in the near term.

Source: RICS

Focus on Retail

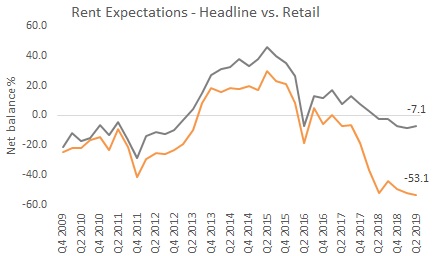

A separate quarterly survey from RICS suggests that sentiment in the retail sector remained firmly in negative territory in Q2 2019 due to the ongoing structural changes within the industry.

Indeed, the tenant demand indicator has been in negative territory for five consecutive quarters, with the retail sector being cited as one of the main contributors weighing on the overall average after reporting a net balance of -59%. What’s more, availability of office space within the sector is now at its highest level for nine years (+52%).

Looking at near term rental expectations suggests a significantly bleaker outlook for the retail sector (-53% net balance) with prime and secondary retail rents expected to fall by 3.5% and 7.0% respectively.

What's more, retail capital value projections remain firmly in negative territory over the next twelve months with sharp declines in the North East and Greater London expected.

Source: RICS

Back to Retail Economic News