RICS Residential Market Survey August 2023

Buyer enquiries and agreed sales decline

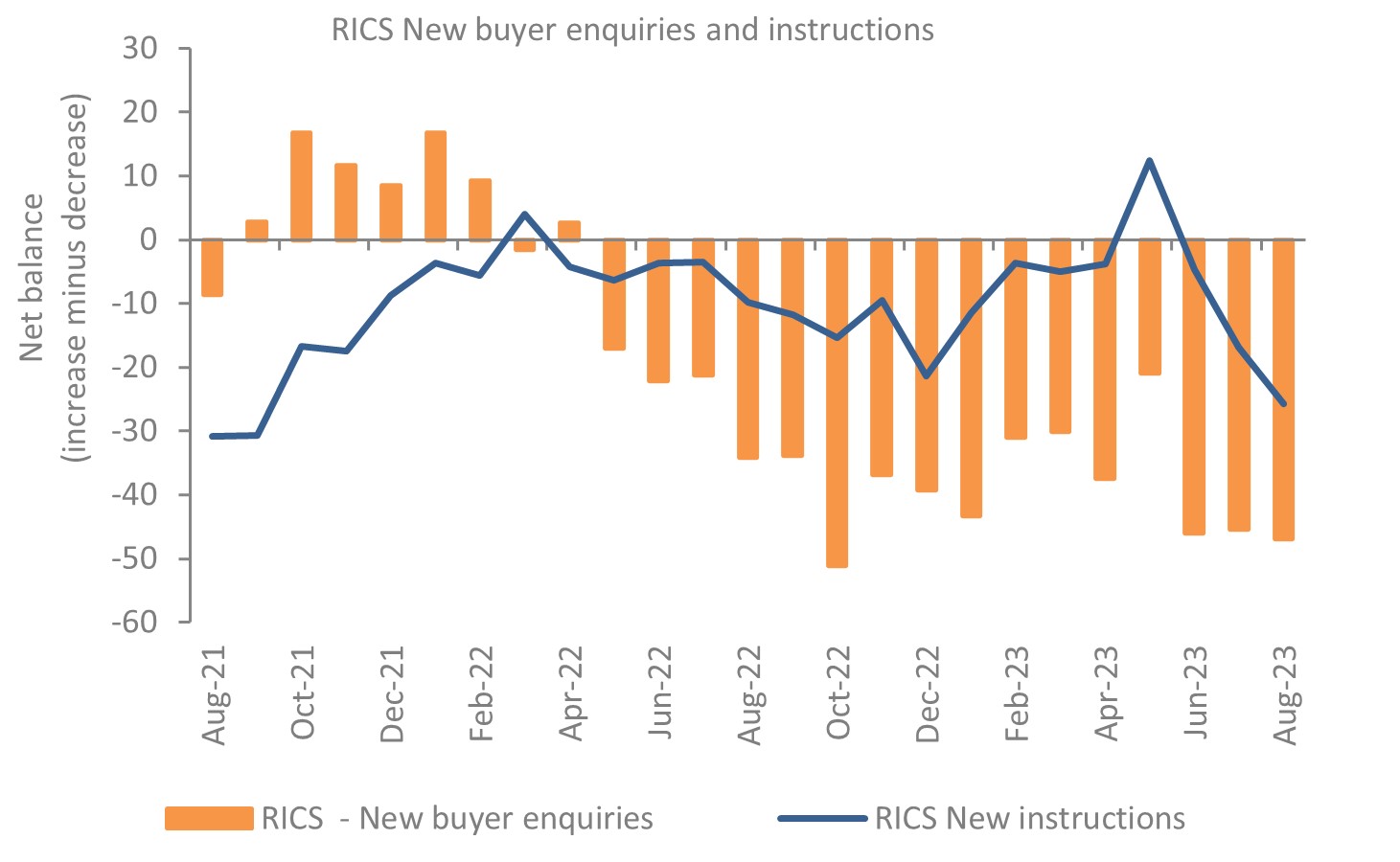

- Buyer enquiries continue to decline with a net balance of -47% in August.

- Agreed sales also remained negative, with a net balance of -47%, the weakest reading since the early stages of the pandemic.

New instructions deteriorate

- Fresh listings coming onto the sales market show a renewed deterioration in supply, as the new instructions net balance slipped to -26% in August.

- The number of market appraisals undertaken in the month remains lower than the previous twelve months according to a net balance of -40% of respondents.

Buyer enquiries and new instruction remain in decline

Source: RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%).

Prices deep in decline

- Widespread falls in house prices saw the net balance for the headline house price metric slip to -68% in August, from -55% in July, the weakest reading since February 2009.

- Virtually regions of the UK are experiencing a decline in house prices.

- Northern Ireland is the only part of the UK displaying a positive net balance for house prices (+7%), although this is the softest reading since 2013 (discounting the early months of the pandemic).

Outlook

- Near-term sales expectations remain weak, with a net balance of -38% for sales expectations in August, up from -45% in July, but still firmly in negative territory.

- For the year ahead, the net balance for sales expectations was -5%, significantly more positive than the -5% reading in July.

- Near-term price expectations fell deeper into negative territory with a net balance of -67% compared with -60% last month.

- Price expectations for the next twelve months was little changed from the previous month with a net balance of -48% expecting prices to fall.

Rental market

- Tenant demand increased firmly over the three months to July, with a net balance of +47% of respondents citing an increase.

- On the supply front, a net share of -20% of respondents noted a decline in new landlord instructions.

- As a result, a net balance of +63% of respondents expects rental prices to increase.

Back to Retail Economic News