RICS Residential Market Survey December 2022

Buyer enquiries remain low

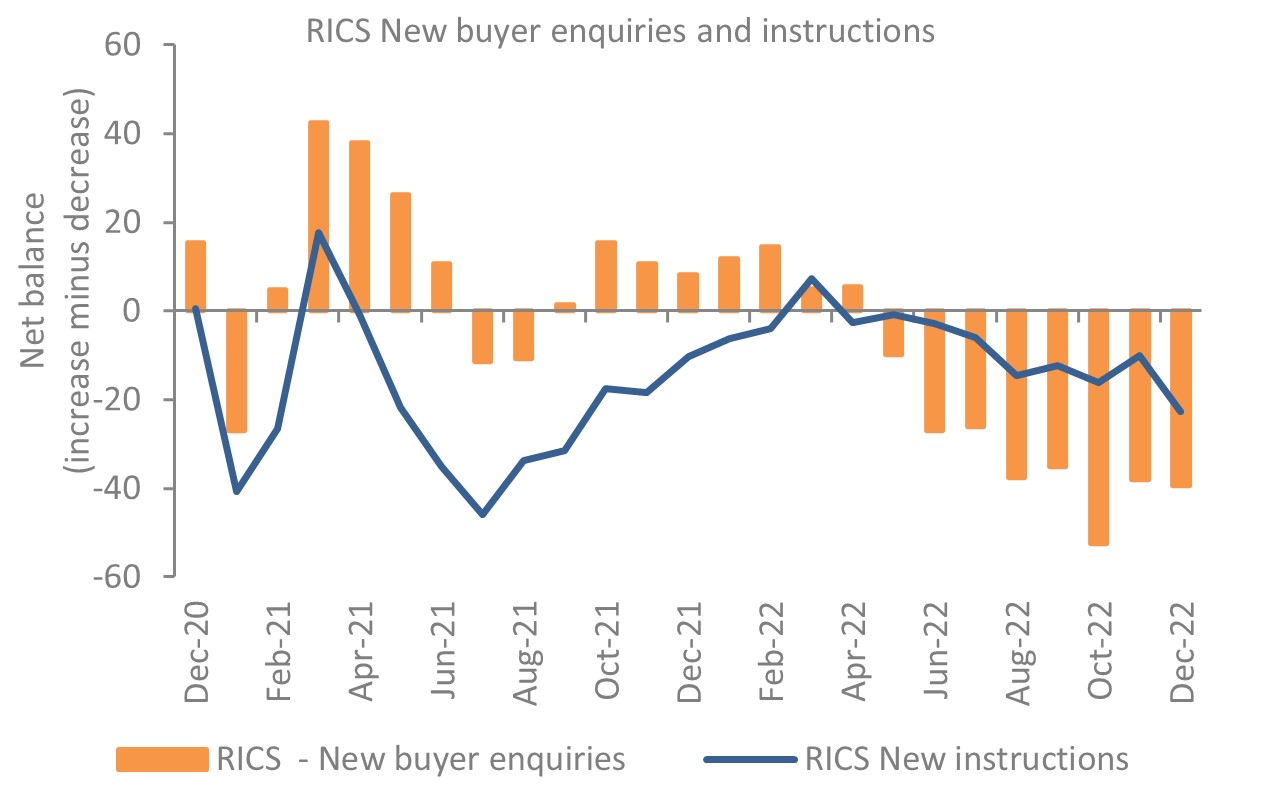

- The RICS UK Residential Survey for December results point to a further deterioration in market conditions, as buyer demand, new instructions and agreed sales continue to fall.

- The net balance for new buyer enquiries fell marginally to -39%, down from -38% in November.

- Buyer enquiries remained negative for the eighth successive month.

- In terms of agreed sales, a net balance reading of -41% was posted in December, down from an already negative reading of -36%.

Inventory levels plummet

- With respect to new instructions, the latest net balance of -23% (down from -9% in November) points to a sharp decline in properties available on the market.

Buyer enquiries remain in negative territory for the eighth successive month

Source: RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%).

Price growth continues to slow

- The downward trend in prices is intensifying as the national net balance for house prices fell to -42% in December, down sharply from -26% in November.

- Prices are softening across England, with East Anglia and the South East experiencing the sharpest rate of decline.

- House price readings across Scotland and Northern Ireland are still in marginally positive territory, but price growth has softened significantly over the past six months.

Energy efficiency becomes a key factor

- 40% of respondents reported a greater interest from buyers in homes that are more energy efficient.

- 41% of respondents noted sellers were trying to attach a price premium on homes on homes with a high energy efficiency rating, while 61% of contributors (excluding those that did not have a view) stated that highly energy efficient homes were holding their value in current market conditions.

Outlook

- Near-term sales expectations slipped deeper into negative territory, at -54% in December, down from -46% in November.

- Over the year ahead, a net balance of -42% of respondents foresee sales slipping, broadly in line with readings over the last three months.

- Price expectations for the next three months have dropped to -66% after a net balance of -58% in November

- Respondents across virtually all parts of the UK envisage that prices will see some degree of decline over the next three months.

- Price expectations for the next twelve months have risen marginally to -57% after a net balance of -61% in November. But this remains firmly in negative territory.

Rental market

- Tenant demand continues to rise according to a net balance of +28% of contributors, although this is down slightly from +35% in November, and the least elevated reading since February 2021, suggesting softening demand across the rental market.

- On the supply front, a net share of -24% of respondents noted a decline in new landlord instructions, up slightly from last month’s reading of -27%, but still considerably below October’s reading of -14%.

- As a result, near-term expectations point to further strong growth in rental prices over the coming three months.

Back to Retail Economic News