RICS Residential Market Survey January 2024

Buyer enquiries and agreed sales improve

- Buyer enquiries saw a significant improvement in January, with a net balance reading of +7%, a notable increase from the previous figure of -3% (RICS). This marks the most positive reading since February 2022, indicating a gradual recovery in buyer demand.

- Agreed sales also saw a positive shift, returning a net balance reading of +5%, compared to the previous reading of -5%.

New instructions edge up

- January saw a small uptick in new instructions entering the market, as evidenced by a net balance reading of +11% (RICS). This marks the most optimistic reading for this measure since March 2021.

- Additionally, a net balance of +9% of respondents observed an increase in market appraisals compared to the previous year, marking the first time this measure has been in positive territory since early 2022.

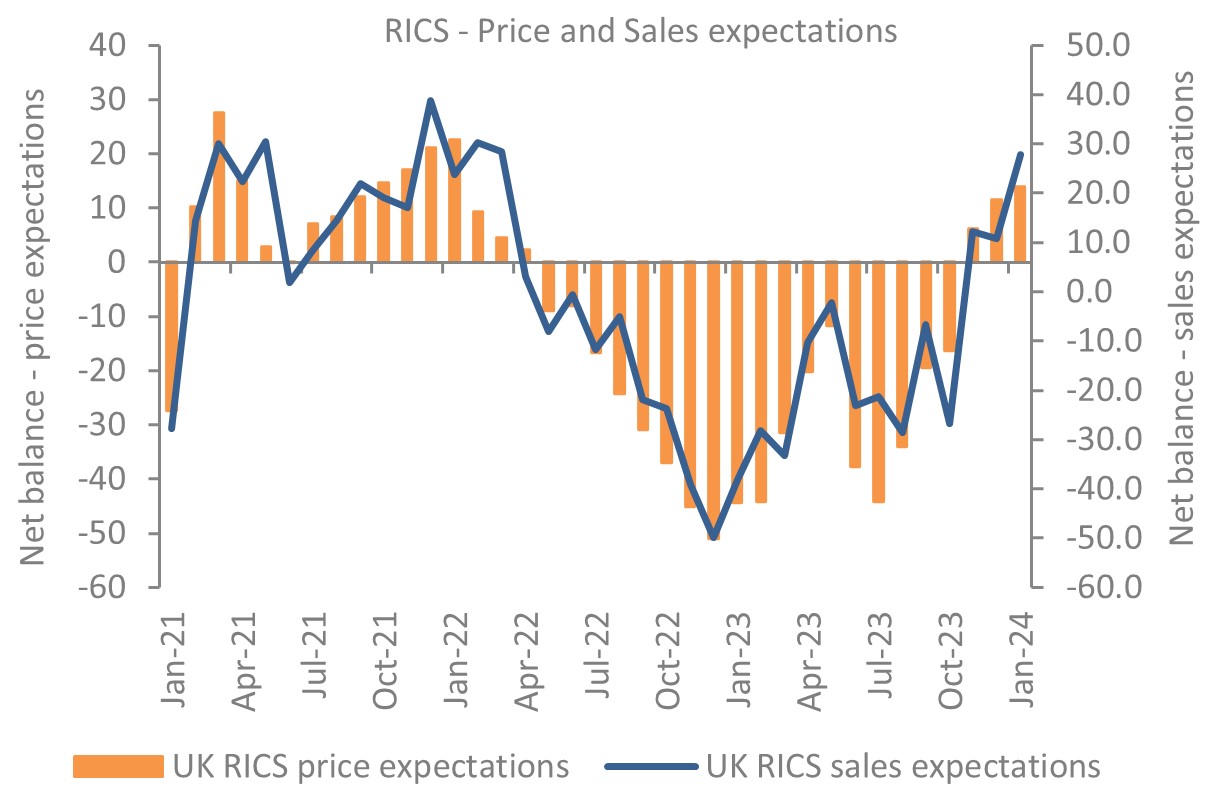

Price and sales expectations stabilise

Source: RICS

Price declines show signs of easing

- Despite remaining in negative territory, the net balance for the headline house price metric in January was -18%, indicating a deceleration in house price declines compared to previous months.

Outlook

- Near-term sales expectations remained in positive territory in January, with a net balance of +14% compared to readings of +11% and +6% in December and November respectively.

- For the year ahead, the net balance for sales expectations was optimistic at +44%. Near-term price expectations have stabilised at the national level, with the net balance moving to -2% from -12% previously.

- Moreover, a net balance of +18% of respondents anticipate a mild increase in house prices over the next twelve months, the strongest reading since July 2022.

Rental market

- Tenant demand continued to rise in the three months to January, albeit at a more modest pace compared to previous periods, with a net balance of +28%.

- Conversely, new landlord instructions remained in decline, with the net balance staying at -18% for the second consecutive quarter.

- The persistent imbalance between supply and demand is expected to drive rental prices higher, although the net balance for this expectation has slightly eased to +41% from previous quarterly readings of +52% and +61%.

Back to Retail Economic News