RICS Residential Market Survey July 2024

Buyer enquiries and agreed sales stabilise

- The July 2024 RICS UK Residential Survey results indicate a largely stable trend in housing market activity, a slight reduction in negative trends.

- This was supported by a modest easing in mortgage interest rates, with respondents anticipating a meaningful pick-up in sales volumes moving forward.

- New buyer enquiries posted a net balance of +2%, up from -6% previously, marking the first positive reading in four months.

- Agreed sales showed a slight improvement, with a net balance of -2%, compared to -13% in May and -6% in June.

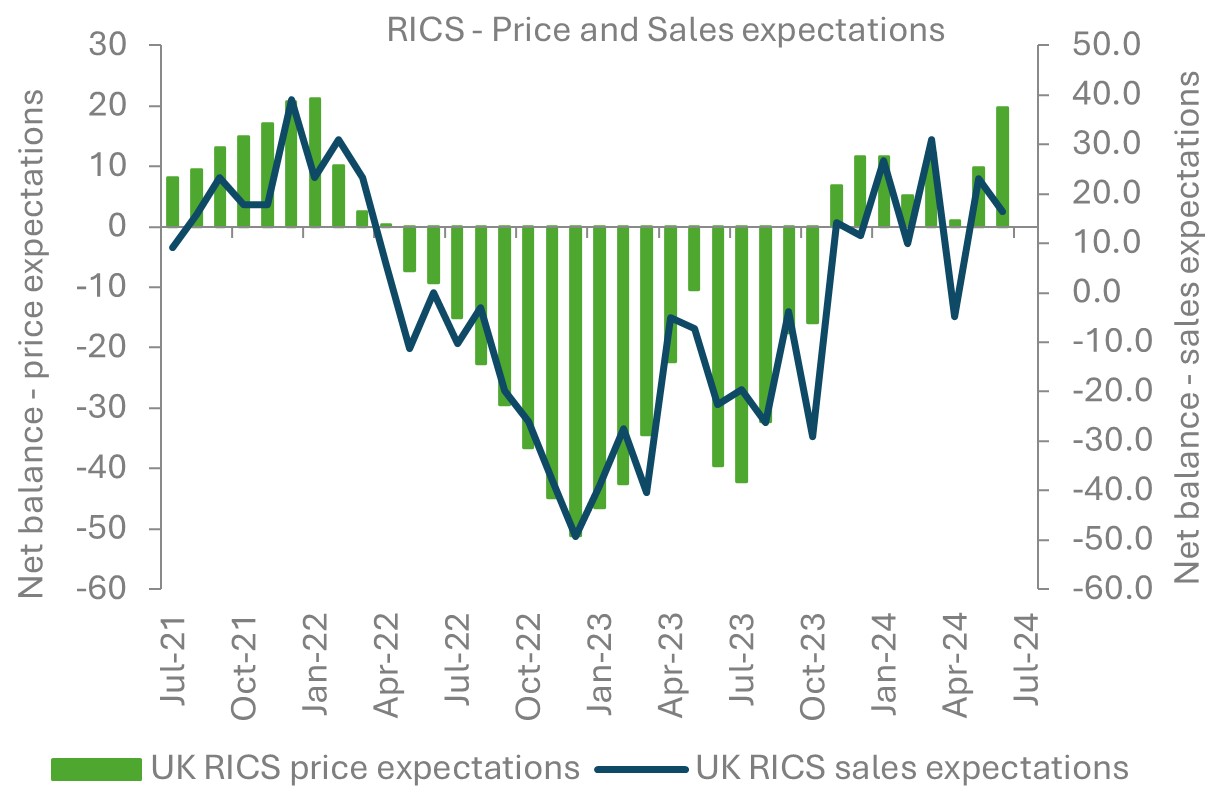

- Near-term sales expectations improved, with a net balance of +30% expecting sales to rise in the next three months, the strongest since January 2020.

New instructions stay flat

- New instructions indicator returned a net balance of +2%, indicating a broadly flat trend.

- Market appraisals remained stable, with a net balance reading of +1%, unchanged from the previous month.

Annual rate of growth rise to 2.3%

Source: RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%).

House prices decline

- The national house price indicator remained negative, with a net balance of -19%, slightly more negative than the -17% last month.

- House prices registered a net balance of -19%, with most regions in England showing flat or negative trends, particularly in East Anglia and Yorkshire & the Humber, while Scotland and Northern Ireland continued to see upward moves.

Outlook:

- Near-term price expectations strengthened slightly, with a net balance of +9%, up from +6% in June.

- Twelve-month price expectations remained positive, with a net balance of +46% expecting prices to be higher in a year’s time, up from +41% last month.

- The twelve-month outlook remains positive, with a net balance of +45% of respondents anticipating an increase in sales activity, up from 40% in June.

Rental market

- Tenant demand rose modestly, with a net balance of +18%, though this is more moderate compared to the +32% average over the past twelve months.

- New landlord instructions showed a net balance of -16%, suggesting a deteriorating flow of listings in the rental market.

- Near-term rental price expectations indicate continued increases, with a net balance of +33%, though this is the least elevated since Q1 2021.

Back to Retail Economic News