RICS Residential Market Survey June 2023

Buyer enquiries remain in decline

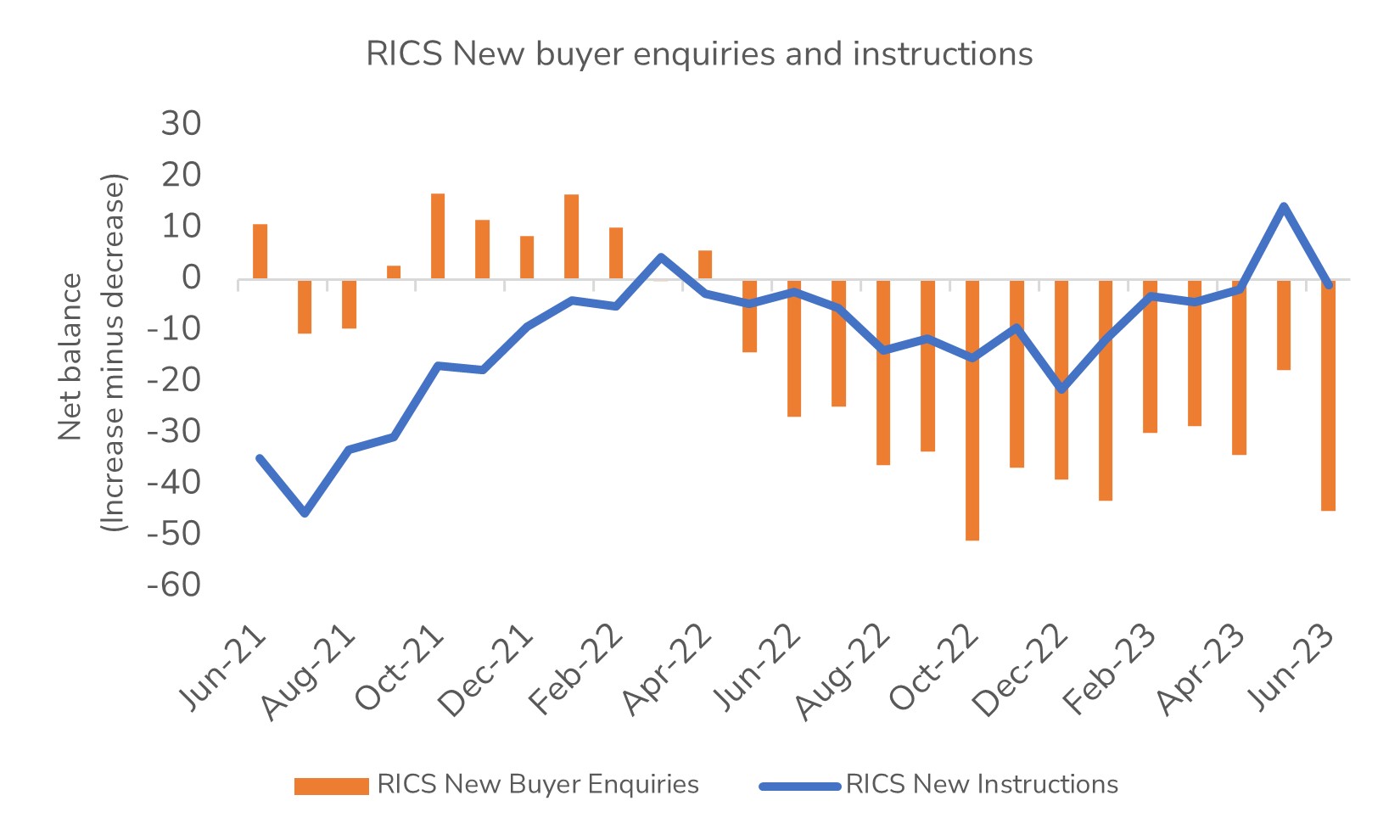

- Buyer enquiries fell considerably on the previous month (-20%) with a net balance of -45% in June, marking an eight-month low.

- In terms of agreed sales, a net balance reading of -34% was posted in June, down from -8% in May, the most pessimistic reading since December 2022 (-38%).

Inventory levels steady

- With respect to new instructions, the latest net balance was -1%, remaining steady after a positive reading of +14% in May.

- The average number of properties on estate agents’ books was 37.4 in June but remains low on a historical comparison and below the average seen over the past five years.

Buyer enquiries decline further

Source: RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%).

Prices in decline

- The national net balance for house prices fell to -46% in June, down from -30% in May.

- All English regions saw experienced declines, while house prices are more resilient in Northern Ireland and Scotland.

Outlook

- Near-term sales expectations reached a four-month low in June, with a net balance of -36%.

- For the year ahead, the net balance for sales expectations was -31%, bringing an end to a three-month period of more optimistic readings.

- Price expectations for the next twelve months have seen a sudden decline with a net balance of -49%, compared to -3% in May.

Rental market

- Tenant demand continues to rise, according to a net balance of +40% of contributors.

- On the supply front, a net share of -36% of respondents noted a decline in new landlord instructions.

- As a result, a net balance of +53% of respondents foresee rental prices increasing.

Back to Retail Economic News