RICS Residential Market Survey March 2022

Buyer demand solid

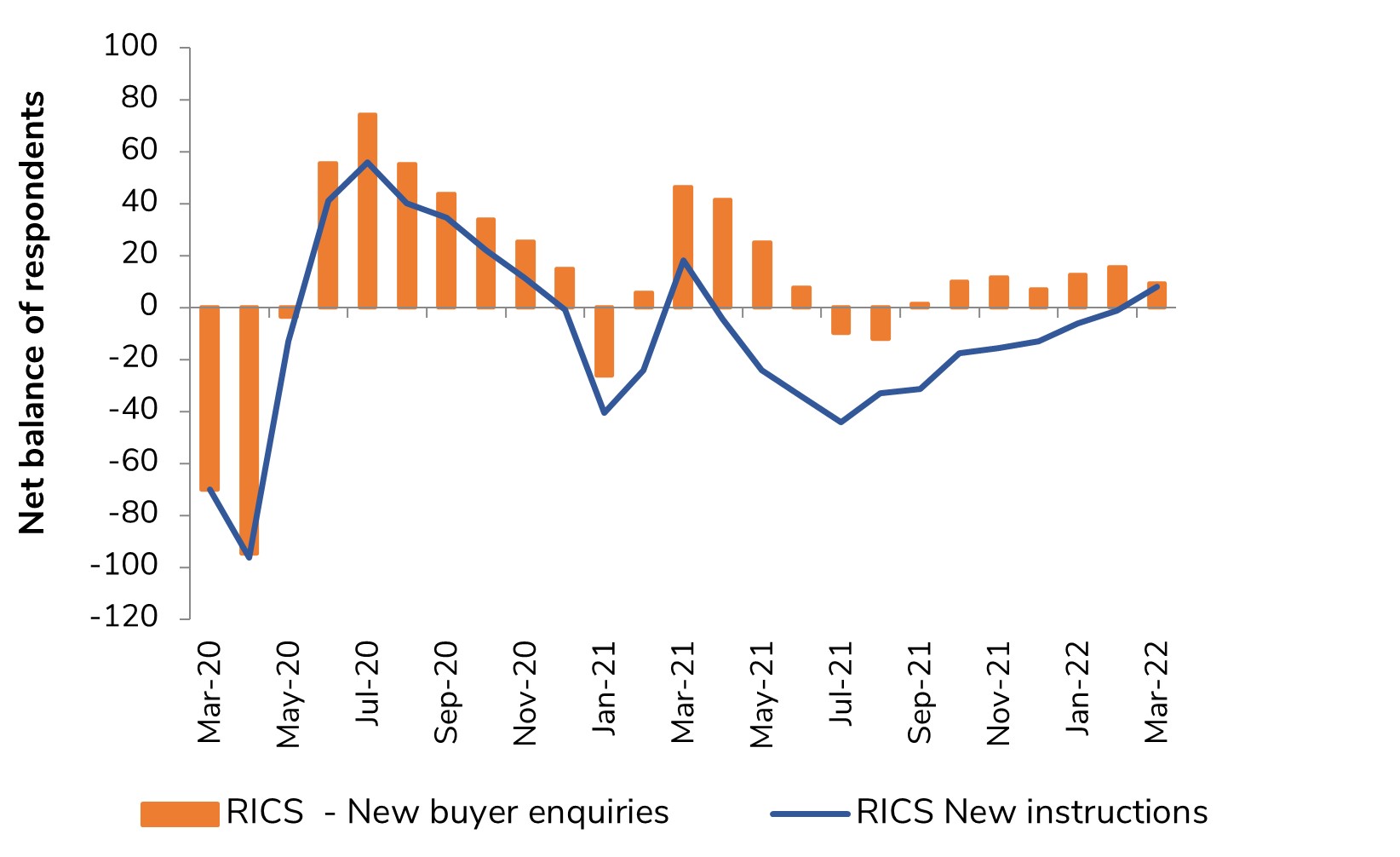

- The RICS UK Residential Survey for March shows a net balance of +9% of agents noted a rise in new buyer enquiries.

- Although still positive, the reading for enquiries is a little softer than the +16% recorded in February.

- Agreed sales rose in March according to net balance of +9% of contributors. This reading in unchanged from February and remains indicative of a steady upward trend in transactions.

New instructions turn positive

- Respondents cited a rise in the volume of fresh listings coming onto the sales market for the first time since March 2021.

- While only marginally positive, the current net balance for new instructions of +8% brings the survey’s metrics tracking changes in demand and supply more closely into line.

- Agents have also reported slight year on year growth in the number of appraisals being undertaken in each of the past three months.

- Despite more encouraging signs on the supply side of late, the current level of inventory remains close to historic lows.

Supply improves as instructions turn positive for first time in a year

Source: RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%).

Price growth still elevated

- At a national level, a net balance of +74% of agents noted a rise in house prices in March.

- This is aligned with the previous month’s results and almost identical to the average seen for this indicator over the past twelve months (+75%).

- All parts of the UK continue to report a further uplift in prices, with Wales and the North of England seeing especially sharp rates of growth.

Outlook stable

- Respondents envisage a further rise in house prices over a three and twelve-month horizon, posting net balances of +30% and +65% respectively.

- Over the next five years, contributors to the survey envisage house prices rising by just over 4%, per annum, at the national level.

- Near term sales expectations remain modestly positive, with the latest net balance coming in at +16% (up from +11% previously).

- Further ahead, the twelve-month expectations indicator now points to a broadly stable outlook for residential sales volumes at the national level.

Rental market

- Tenant demand continues to rise at a robust pace, evidenced by a net balance of +54% of contributors noting an increase in March.

- Interestingly, landlord instructions were reported to have increased for the first time since July 2020, with the latest net balance improving to +6% from -21%.

- A net balance of +64% of agents expect headline rents to be higher in three months’ time – amongst the strongest readings on record.

- Over the next twelve months, survey contributors foresee UK rental prices rising by c. 4.0% on average.

Back to Retail Economic News