RICS Residential Market Survey November 2024

Key Takeaways

Buyer enquiries and agreed sales stabilise

- The November RICS Residential Survey highlights stable sales market activity, with positive trends in demand, sales, and instructions.

- New buyer enquiries posted a net balance of +12%, consistent with the previous month, marking the fifth consecutive month of positive growth.

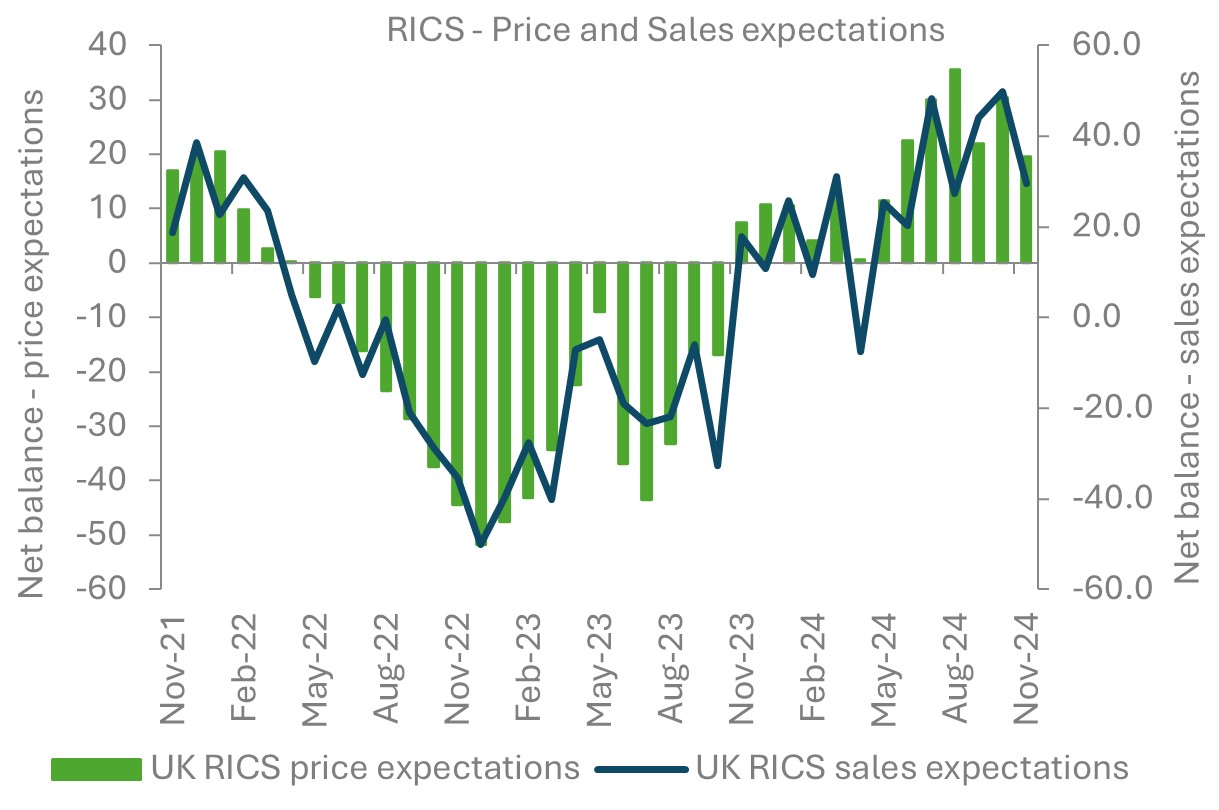

- Agreed sales registered a net balance of +1%, down from +8% in October, indicating flat sales volumes for the month.

- Near-term sales expectations show a net balance of +19%, while +33% of contributors expect sales volumes to rise over the next 12 months.

New instructions rise

- The new instructions indicator recorded a net balance of +17%, marking its fifth consecutive month of growth. Market appraisals have stabilized compared to last year, suggesting a potential slowdown in the pipeline of new listings.

House prices rising at the national level

- The national house price indicator posted a net balance of +25%, up from +16% in October, marking the fourth month of consecutive growth.

- Near-term price expectations remain positive, with +47% of respondents anticipating house prices to rise over the next 12 months.

- Regions with the strongest house price growth include Northern Ireland, North West, North East, and London.

Rental market

- Tenant demand showed a slight decline with a net balance of -1%, marking the first drop since 2020, influenced by seasonality.

- New landlord instructions fell further, with a net balance of -13%, intensifying supply shortages.

- Near-term rental price expectations remained elevated, with a net balance of +29% forecasting rent increases over the coming months.

Housing Market picks up in November 2024- RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%). Source: RICS

Source: RICS

Back to Retail Economic News