RICS Residential Market Survey September 2024

Buyer enquiries and agreed sales stabilise

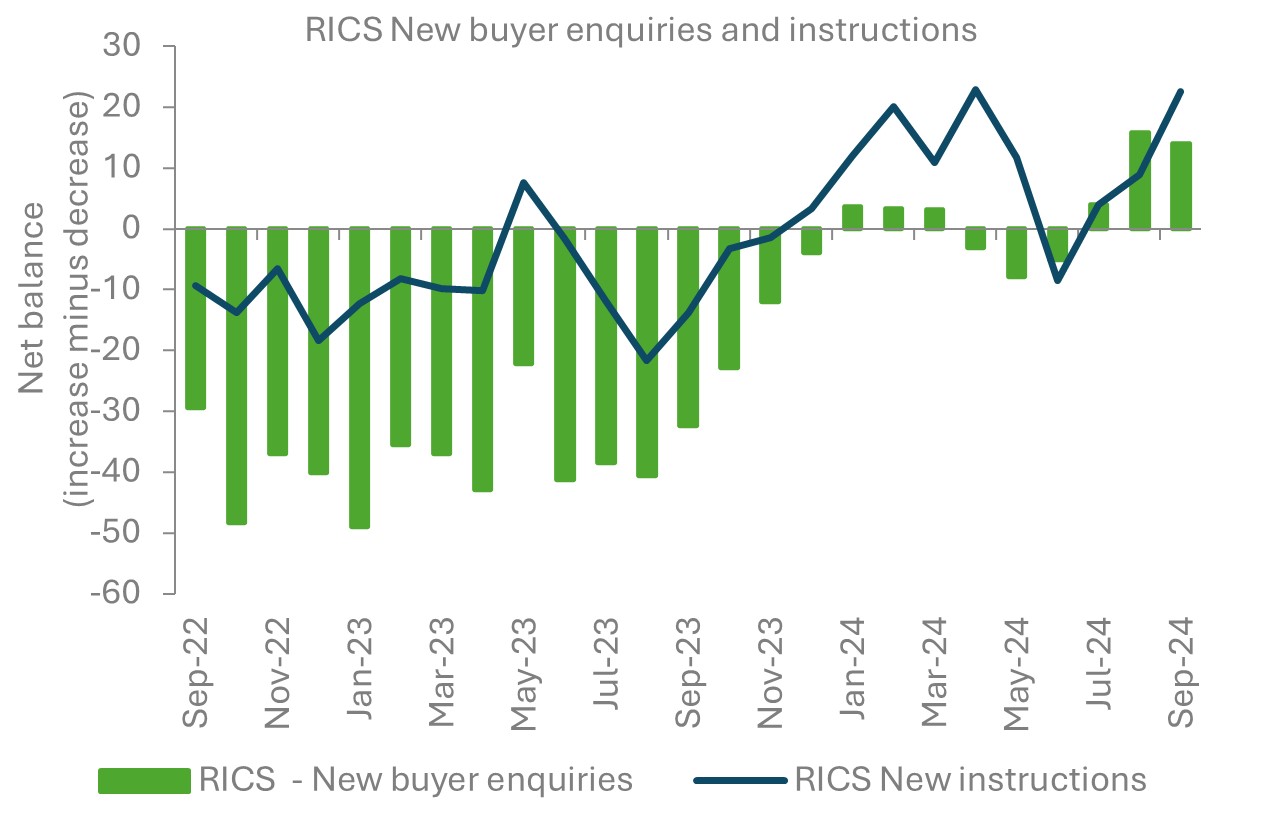

- The September RICS Residential Survey results show continued improvement in sales market activity, with sustained positive readings in demand, sales, and listings.

- New buyer enquiries posted a net balance of +14%, marking the third consecutive month of positive demand growth.

- Agreed sales registered a net balance of +5%, marginally down from +6% in August, but still reflecting an upward trend from earlier in the year.

- Near-term sales expectations suggest further improvement, with a net balance of +44% expecting sales volumes to rise over the next three months.

New instructions rise

- New instructions indicator returned a net balance of +22% up from +9% in August.

- Market appraisals also rose, with a net balance of +23% of contributors reporting more appraisals, indicating a solid pipeline of properties expected to come to market.

New buyer enquires rise to 14%

Source: RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%).

House prices rising at the national level

- The national house price indicator moved into positive territory, with a net balance of +11%, up from zero in August and -16% in July, marking the first rise in prices since October 2022.

- Near-term price expectations show a net balance of +12%, and a net balance of +54% of respondents anticipate higher prices over the next twelve months.

Rental market

- Tenant demand rose in September, with a net balance of +22%, slightly higher than the +11% recorded in the previous month.

- New landlord instructions continued to decline, with a net balance of -29%, exacerbating the supply shortage in the rental market.

- Near-term rental price expectations remain strong, with a net balance of +39% expecting rental prices to increase in the coming months.