The Cost of Living Crisis: The Effect on Different Consumers

This article is part one of our four-part mini-series, derived from our report in partnership with Grant Thornton 'The Cut Back Economy,' which explores the impact of the cost-of-living crisis on the UK retail, leisure, and consumer sectors. Our research shows that nearly 90% of UK consumers will need to reduce their spending on non-essentials.

5 minute read

The UK economy is facing severe headwinds due to soaring inflation, slower growth, and tightening monetary policy. This is occurring amidst heightened geopolitical tension, and emerging from a global pandemic has only provided temporary relief. Economic volatility is the new reality for many households, with the sharpest squeeze on disposable incomes in generations leading to fears of an oncoming recession.

Stagflation is evident in high unemployment rates and slow economic growth, coupled with rising inflation. Inflation is currently at a 40-year high and is expected to reach 11% by the end of 2022 due to an increase in the energy price cap. This level of inflation is unprecedented for most consumers. The Bank of England has raised interest rates for the fifth consecutive time in June 2022 to balance inflation control and economic growth. Initially thought to be a transitory reopening effect after the pandemic, inflation has risen more persistently due to global supply chain distortions, Brexit's softening impact on trade flows, and higher commodity prices. This situation has also led to a decline in consumer confidence.

As a result of their budgets being squeezed, many consumers will be forced to adopt recessionary behaviours such as saving less, trading down, or cutting back on spending. A significant percentage of consumers (41%) expect this squeeze on living standards to impact their spending habits until at least the end of 2023, which could have negative implications for the retail, leisure industries, and wider economy.

Household Polarisation

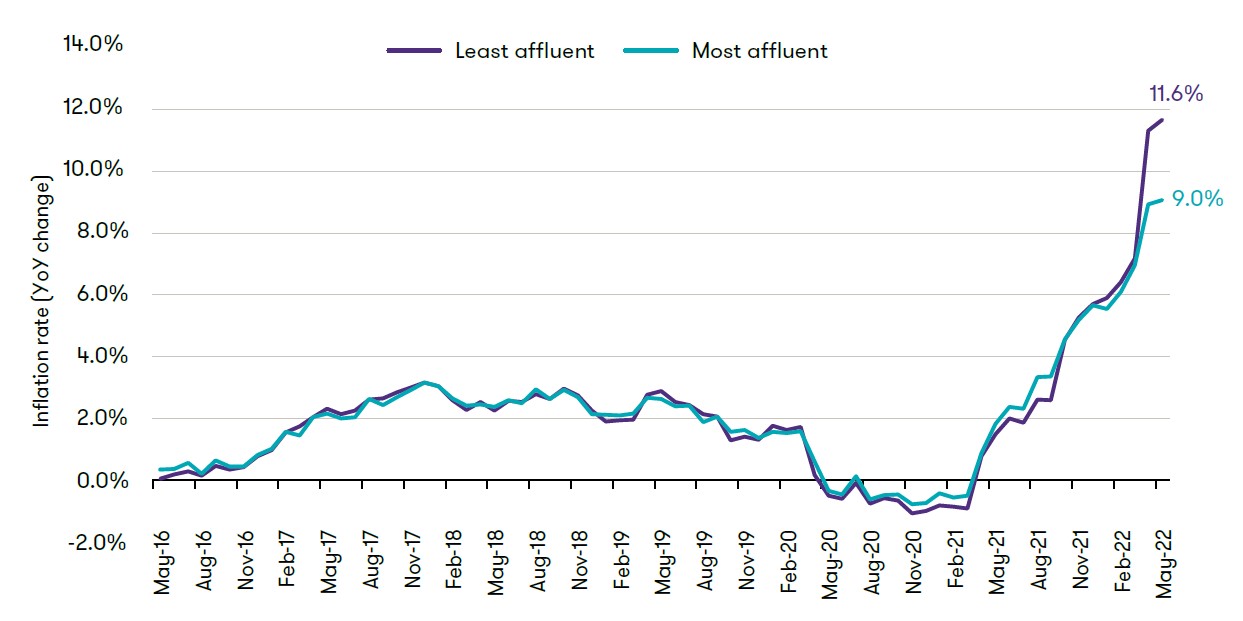

The cost-of-living crisis affects households differently, with those on lower incomes or with debt being more vulnerable to inflationary shocks due to a lack of savings. The least affluent spend close to two thirds of their budget on staples like food and energy, while the most affluent spend less than half. Our research shows that the least affluent are experiencing inflation at a rate of almost 12%, compared to around 9% for the wealthiest households.

Fig 1: In May 2022 less affluent households inflation rates were 2.6% higher than more affluent households

Source: Retail Economics