The educational experience can assume many forms across the customer journey with applicability for high value or technical products that require more involved processes. In many cases, educational experiences will be supported by in-store personnel or increasingly using digital content (e.g. operational guides, explainer videos, help lines, chatbots, online FAQs etc.).

During ‘non-essential’ store closures, many retailers had to rely on their staff’s product knowledge base and interpersonal skills to serve customers virtually during the crisis. For example, Dixons Carphone launched ShopLive, a video tool that connects online shoppers with in-store personnel to get expert advice and view product demonstrations from the comfort of their own homes. The service has proven so popular with customers that the retailer plans to continue it on a permanent basis, even after its stores reopen.

This is just one example of marrying online with offline, using digital solutions to provide customers with a valuable, educational, face-to-face experience with in-store personnel with immediacy and convenience that online provides.

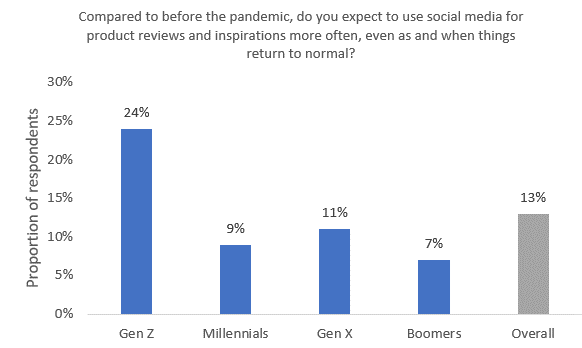

Fig 2: 24% of Gen Z will use social media for reviews and inspirations even after things return to normal

Source: Retail Economics

Retailers should now consider new touchpoints for educating and engaging with customers, such as social media and virtual demos. Such technology not only provides next-generation customer experience; it also gives retailers access to valuable data that can feed into personalization algorithms or used for price optimization and promotions. To learn more about the other drivers of the post-pandemic consumer experience, click here to head back to the first article in the series, which looks at the post-pandemic shopping ‘environment’

Things to do now

Download the full report here

Found this

short article interesting?

This article is the last in a four part mini-series from our report “The Retail Experience Economy 2.0”.

- Part one can be found here

- Part two can be found here

- Part three can be found here

The insight in this report is critical for industry professionals operating in the retail and related industries for improving strategic planning, forecasts and to navigate the ongoing disruption and wider structural changes with the retail sector.

View Full

Report Here