What's in this report?

This monthly sector snapshot report provides you with a category overview of 7 key categories within the retail industry, these categories are:

- Food & Grocery

- Clothing & Footwear

- Homewares

- Furniture & Flooring

- DIY & Gardening

- Electricals

- Health & Beauty

Our Sector Snapshot report also includes macroeconomic insights for the month including:

- Housing Market Data

- Consumer Spending

- Cost Pressures

- Chartbooks

- Labour Market

- And more...

Download your free report now

You can get a free copy of this report in two ways:

1. Complete the form at the top of this page

2. Sign up for a free membership trial and get this report, and much more, as part of a complete insight experience to see how our data and analysis can improve what you do.

Example insights

Food & Grocery

Food & Grocery Sales - Food & Grocery sales increased by 10.7% YoY in February, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Little Signs of Food Inflation Abating - Food inflation is lifting sales values, but dragging down volumes as consumers pay closer attention to budgets and purchase fewer items. In volume terms, Food & Grocery sales fell 3.4% YoY in February.

Grocery sales continue to be driven by 45-year high food inflation. Food inflation accelerated 18.0% YoY in February, from 16.7% in January.

The sharper-than-expected rise in food inflation was partly driven by availability issues. During the month, most major retailers rationed certain fresh produce lines as shortages of salad crops hit the UK.

Poor weather in Europe and North Africa was blamed, along with high energy prices that disincentivised domestic production over winter. Domestic production of salad, including cucumbers & tomatoes, fell to the lowest level since records began in 1985, according to the NFU.

Sector Outlook - With utilities, broadband, and council tax bills rising in April, consumers will continue to prioritise ways to reduce costs, such as switching stores, reducing basket sizes, and cutting back on activities like dining out and takeaway orders.

Against this backdrop, retailers will be hoping for Easter to boost sales, as shopping by ‘occasion’ becomes more popular. The Easter holiday is traditionally a time when supermarkets recover sales from discounters, primarily by offering a wider selection of branded Easter eggs.

High inflation will continue to boost top-line growth across the sector, but sales volumes will decline as households economise on their food shop to combat rising living costs.

Clothing & Footwear

Financial Updates - Clothing sales increased 5.0% YoY in February, with Footwear growing by a stronger 7.6% according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Price rises are lifting retail sales in value terms, but dragging on volumes as consumers spend more due to inflation rather than buying more items. With apparel inflation running at 8.7%, the decline in Clothing sales volumes deepened in February, falling by an estimated 3.7% YoY.

Less Discounting - Clothing and footwear spending weakened in Feb after the Jan sales ended, as consumers delayed purchases to wait for better deals. Retailers shifted focus to full-price sales to maintain profitability, but cash-strapped consumers held back on updating their wardrobes.

Sector Outlook - Expectations over the length and depth of the UK’s economic downturn have drastically improved since the end of last year – with the Bank of England now forecasting the UK to narrowly avoid recession in 2023.

Inflation is set to drop sharply to 2.9% by the end of 2023, with the path for interest rate rises also expected to be less steep than initially feared.

Next said it will raise prices less than previously expected as inflation will be more "benign". Price inflation is now expected to be 7% in spring/ summer and 3% for autumn/winter, down from 8% and 6% respectively.

We anticipate a 'year of two halves' for the Clothing & Footwear sector in 2023. The first 6 months will be tough as cost pressures remain intense for consumers and businesses, but we expect sales volumes to recover over H2 2023 as confidence picks up and inflation unwinds.

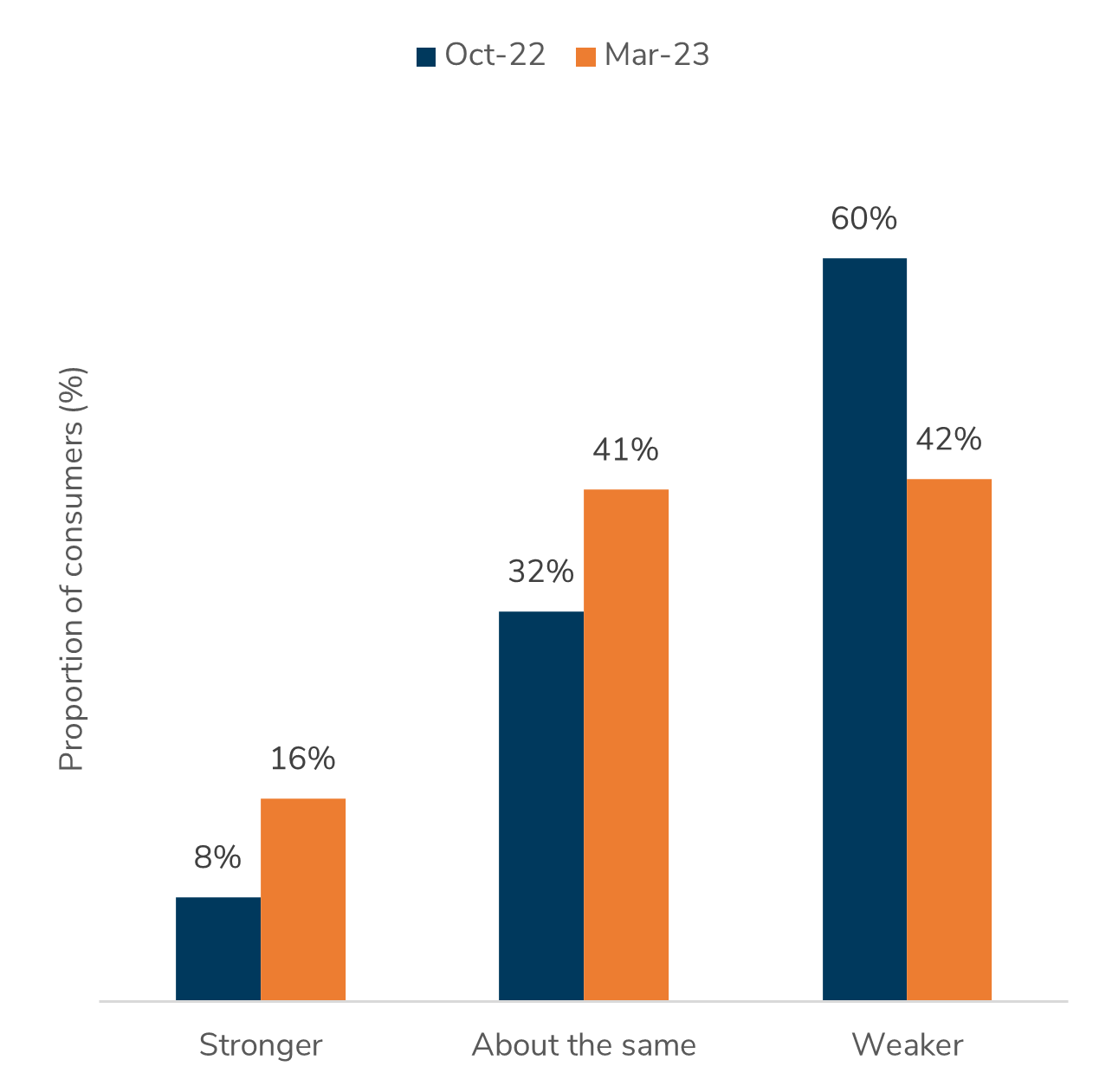

Sentiment Improving: How do you expect your personal finances to change over the next three months?

Source: Retail Economics Shopper Sentiment Survey. N=2000

Don't miss out on key monthly insights like these and many more, download your free report now!