Continuing shift towards online further impacts retail profit margins

3 minute read

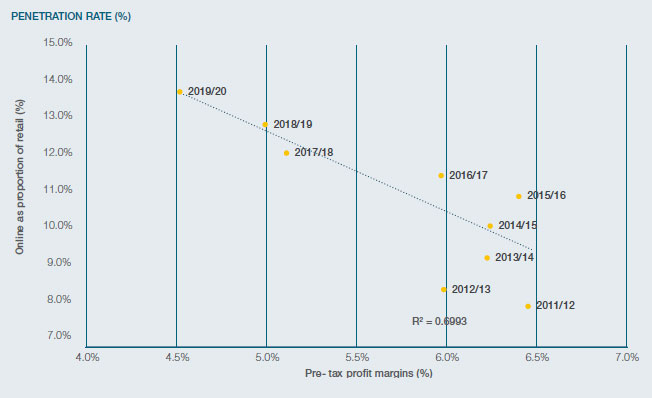

The impact of Covid-19 will accelerate the migration towards online well beyond the step-change European markets have already experienced. Our research has shown that the shift towards online is a significant contributing factor to dwindling profit margins, revealing an inverse correlation between a rise in the proportion of online sales and a fall in pre-tax profit margins over the last decade.

This is the fourth of five articles based on a wider piece of research on the true cost of the shift to online by Retail Economics and Alvarez and Marsal.

Indeed, pure online retailers typically operate on considerably lower margins than multi-channel and brick-and-mortar business models. Our analysis shows average pre-tax profit margins for pure online retailers across the key European markets analysed resided at 1.4%, compared with 5.4% for the total industry. This reflects the difference in cost structures, business models and the price sensitivity of consumers, where transparency in price, service and quality places further downward pressure on margins. As penetration rates rise across Europe, many retailers will undergo a period of transition where profit margins come under intense pressure as operating models and cost structures are put to the test.

Profit margins fall as penetration rates rise - Penetration Rate (%)

Source: Company reports, Retail Economics and Alvarez & Marsal analysis (includes the U.K., Spain, Italy, France, Germany and Switzerland)