Online retail penetration differs across Europe during Covid-19

3 minute read

Online retail sales in Europe hit record highs during lockdowns in 2020-21 as consumers embraced e-commerce options for the first time across many categories. Consumers also became increasingly dependent on other categories as Covid-19 measures 'forced' certain shopper bevaviours.

This is the second of five articles based on a wider piece of research on the true cost of the shift to online across Europe by Retail Economics and Alvarez and Marsal.

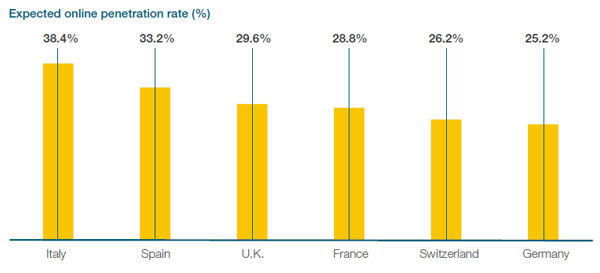

Across the six European countries analysed (U.K., Germany, France, Italy, Spain and Switzerland), just under a third (30.1%) of household expenditure is expected to permanently shift online as a result of Covid-19, a considerable uplift from 14.8% in 2020.

However, the migration towards online will not be uniform across each country due to differing market conditions such as online maturity, market competition, regulation, infrastructure, and many other factors.

Expected permanent shift towards online by country - Expected online penetration rate (%)

Source: Retail Economics and Alvarez & Marsal

Our research showed that in markets such as Italy and Spain, where online penetration rates are relatively low and the online proposition less mature, consumers expect to see a greater permanent shift in their online spending. In part, this is likely to reflect consumers in these markets shopping online in some product categories for the first time. For example, our research showed that the proportion of consumers shopping online for the first time for Apparel, Homewares and Toys was highest in Spain compared with the other European markets we analysed.

[Continued below]