5 Key Retail Trends in 2022

8 minute read

This article is the last in a three part series and identifies five key retail trends shaping the industry in 2022. It also touches upon the themes of retail 'acquisitions and partnerships', and the issue of 'relevancy' as disruptive forces continue to reshape the sector.

Be sure to explore part one (Macroeconomic factors impacting retail in 2022) and part two (UK Retail Sales & Forecasts: Category Analysis 2021/2022) of this mini-series which provides additional insights and context to the five trends highlighted here.

All articles are based on our research detailed in our Outlook for UK Retail & Consumer 2022 report which can be downloaded for free.

Reshaping the consumer landscape

Acquistions & Partnerships

Retail, hospitality and leisure sectors were hit hard by the pandemic and the government response, forcing many businesses to quickly adapt their business models for extraordinary trading conditions.

Following the initial ‘survival period’ where businesses cut costs and protected working capital to manage risks, the industry entered a period of consolidation and partnerships.

ASOS acquired Arcadia, Boohoo absorbed Debenhams, and many other partnerships emerged such as M&S and Deliveroo, Next and Morrisons, Dixons and Uber, Sainsbury’s and Amazon, Tesco and Gorillas, Klarna and Hero.

Relevancy

Many consumers have now formed conscious behavioural frameworks when shopping. This has helped delineate their expectations of retailers and clarify the kind of relationships they want with them, often involving less physical interaction. Consequently, retailers will need to provide innovative digital solutions that support customers on a new, virtual customer journey – from product awareness, to service and returns.

Focussing on merging digital and physical realms will be critical as they reassess the value and importance of stores. Companies will require different skills, financing and business models in a bid to remain relevant.

Existing business models will be tested by successive waves of disruption, and from new cohorts of competitors offering solutions in narrow specialisms.

Watch our short video on the 5 key retail trends before getting into the detail

We now detail the five key retail trends which will dominate boardroom agendas throughout 2022...

Trend 1: Digital Dependency

The pandemic has permanently impacted shopping behaviour, affecting every stage of the customer journey, from the discovery of new products and brands, to how shoppers track and return online orders. Periods of lockdown necessitated a shift towards online for many consumers, especially for ‘slow digital adopters’. In many instances, this cohort was ‘forced’ into new ways of shopping that involved unfamiliar digital touch-points on their path to purchase. Furthermore, digital savvy consumers started shopping online within categories they would typically reserve for the in-store visit such as furniture.

As COVID-19 restrictions eased across the UK, consumers reverted to previous shopping habits. However, a significant proportion continue to browse, research and purchase online compared with pre-pandemic times. Indeed, the proportion of online sales has risen from 19% in 2019 to 26% in 2021, with many categories seeing the step change in online sales persisting beyond lockdowns.

Our research found that consumers experiencing the greatest change in their shopping habits during the pandemic are more likely to conduct a higher proportion of their shopping online and do less in-store in future. For this group, over a third of consumers expect to permanently shop less in physical locations, with almost two thirds (63%) expecting to shop more online than they did before the pandemic.

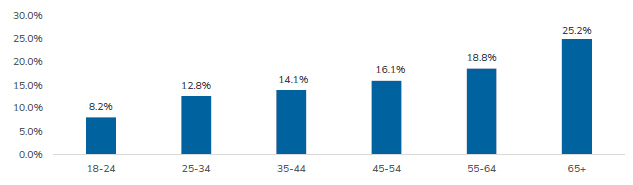

Figure 6 - More than a quarter of consumers over the age of 65 years say there has been a permanent change in the way they shop

Source: Retail Economics

Capacity across the entire e-commerce ecosystem has expanded, businesses have invested significant amounts in more sophisticated digital marketing campaigns, warehouse automation and boosting courier networks to cope with peak order volumes. In many cases, digital transformation accelerated by years in just a matter of months; new technologies were adopted, new partnerships formed, and new business models embraced.

Within this key trend of digital dependency, our research uncovers five micro-trends driving these changes, please go to our full report here for more details.

Trend 2: Rebalancing Physical Retail

The distribution of expenditure across local high streets, shopping centres, retail parks and city centres has altered significantly during the pandemic. Throughout 2021, footfall has fallen markedly on 2019 levels, but retail parks [-3.6%] have held up well relative to shopping centres [-39.6%] and high streets [-38.8%].

Beyond the immediate impact of lockdowns, a key disrupting factor has been the sharp rise in the proportion of people working from home, particularly in commuter belt towns. Commuter towns have retained a greater proportion of city workers whose spending is now more focused in localised areas near their homes. This has come largely to the detriment of city centre locations where footfall levels continue to be significantly lower than in 2019.

Despite the redistribution of spending across physical channels, retailers and leisure operators will continue to merge physical and digital channels as the purpose and value of physical locations evolve. Gone are the days where physical stores are solely purposed for distributing products, accountable for their own profit and loss. The merging of physical and digital realms will become even more critical as retailers leverage technology to inject greater value into stores (e.g. use of AR and using online fulfilment of physical orders).

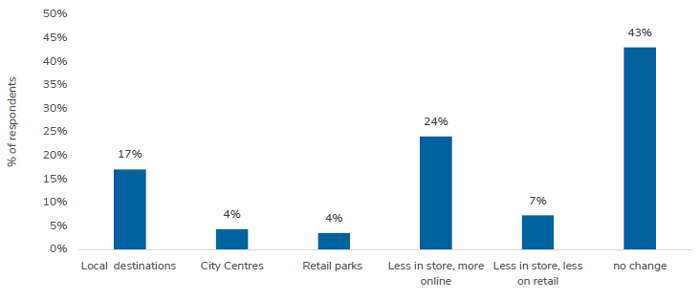

Figure 9 – Those looking to spend more in physical locations intend to do so in local destinations

Source: Retail Economics

As retailers become increasingly sophisticated with their inventory systems and logistics, they will move towards store fulfilment- based models and rapid delivery – particularly in densely populated areas. Indeed, many retailers have increasingly leaned towards their store estates to leverage value in a truly multichannel proposition, winning back market share from pure online players by providing a point of differentiation.

In addition, landlords will have to become much more innovative in their use of space and work more collaboratively with retailers. Pop-up shops and white box spaces that create a healthy churn of independent retailers (relevant to the local communities they serve) can drive sustainable levels of footfall and revitalise tired areas. Elsewhere, provided discounted rental costs make it commercially viable, oversize or redundant stores could be repurposed to facilitate online fulfilment, city centre hubs for consolidating deliveries, convenient click-and-collect locations, or drop-off spot for returns.

Trend 3: Supply chain disruption

COVID-19 has highlighted the fragility of globally-dispersed and complex supply chains. During the initial stages of the pandemic, the closure of factories, ports and disrupted shipping routes dislocated supply chains causing worldwide product shortages.

As economies reopened, global supply chains buckled under the pressure of quickly ramping-up production to meet significant levels of pent-up demand across advanced economies.

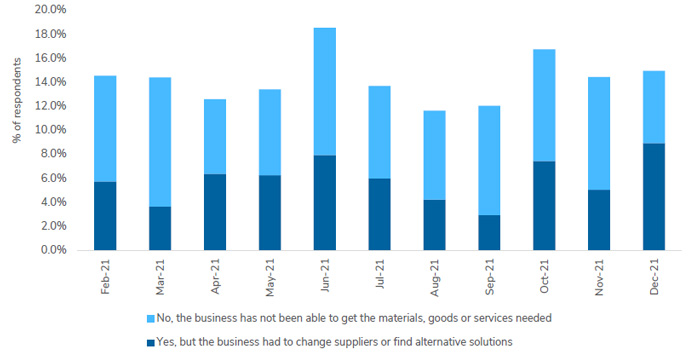

Figure 10 - Supply chain issues for retail and wholesale peaked in the summer but remain at elevated levels

Source: ONS

Combined factors such as COVID-19 outbreaks, port closures, port congestion, labour shortages and a lack of containers caused considerable disruption resulting in rapidly escalating costs. The cost of shipping a container across most major shipping routes rose by more than nine times in 2021 compared with the previous year. A shortage of HGV drivers and Brexit-related complexities caused further delays, exerting pressure on costs.

In fact, UK wholesalers and retailers reported the top five challenges faced when trying to import products as: (1) the ‘change in transport costs’ (53%); (2) ‘additional paperwork’ (37%); (3) ‘customs duties and levies’ (34%); (4) ‘lack of hauliers’ (26%); and (5) ‘disruption at UK borders’ (26%).

All these pressures converged in the Summer of 2021 as retailers, wholesalers and hospitality businesses struggled to acquire essential goods. In October 2021, almost a quarter of UK businesses either had to change suppliers to find alternative products or could not get what they needed because of these disruptions. As such, inventory levels across the sector have been depleted, and in many cases, retailers have not been able to fulfil demand.

Inevitably, consumers faced challenges accessing products. Our research suggests that close to one in five (28%) consumers have experienced issues with product availability in 2021, with 9% saying that it had been a significant issue.

[Article continued below]