Macroeconomic factors impacting retail in 2022

6 minute read

The impact of COVID-19 on the UK retail and consumer sector cannot be overstated. The enforcement of store closures, social distancing measures and heightened anxiety over viral transmission has hit businesses hard. Conversely, the impact has elevated ‘digital’ to new heights across the entire customer journey.

The initial stages of the pandemic saw a seismic shift towards e-commerce throughout major European retail markets as consumers explored new paths to purchase goods and services. These shifts will continue heading into 2022 as the industry undergoes further restructuring. The ongoing impact of supply chain disruption, readjustment to Brexit, rising levels of consumer inflation, and an international conflict with Ukraine, will present considerable challenges for the industry throughout 2022.

This is the first in a series of three articles derived from our “Outlook for UK Retail and Consumer 2022 report.

The macroeconomic impact on retail in 2022

The UK economy achieved an impressive recovery mid-2021 as COVID-19 restrictions were lifted and consumer spending quickly gained traction.

The vaccine roll-out helped restore confidence, vital to a resilient consumer sector which represents two-thirds of the UK’s GDP. Economic growth was also aided by unprecedented fiscal stimulus as ongoing government support for businesses and households remained in place against a backdrop of loose monetary policy.

Households quickly accumulated savings as holiday plans were cancelled and less money was spent on commuting and social events. As economies reopened, demand for many goods and services bounced back strongly.

Conditions became more challenging heading into Autumn as the furlough scheme wound back, accompanied by cuts to benefits and a reduction in business support.

Simultaneously, macroeconomic headwinds gained force as tighter labour markets, supply chain disruption and a sharp rise in inflation dampened prospects for growth. Elevated levels of uncertainty caused many firms to delay investment until conditions are more favourable.

In December 2021,The Bank of England (BoE) raised interest rates for the first time in three years piling further pressure on households, together with impending tax rises and cuts to universal credit. Compounding these factors, the omicron variant hit financial markets hard serving as a stark reminder to businesses, global governments and consumers, that the effects of the pandemic are far from over.

Despite these challenges, expected growth for the UK economy is 6.9% for 2021, and 5.2% in 2022, representing a healthy rebound from the exceptional decline in 2020 and forecasted to reach pre-pandemic levels by the early part of 2022. Forecasts have been downgraded markedly in recent months, reflecting a more challenging outlook than initially anticipated, recovery is expected to be uneven across sectors and regionally. In particular, City Centre locations continue to see footfall considerably lower than other locations (e.g. town centres in the commuter belt and retail parks). Indeed, with the number of tourists remaining considerably lower than 2019 levels, city centre hotels remain under pressure, with some expecting lower occupancy rates to persist through to the latter part of 2023.

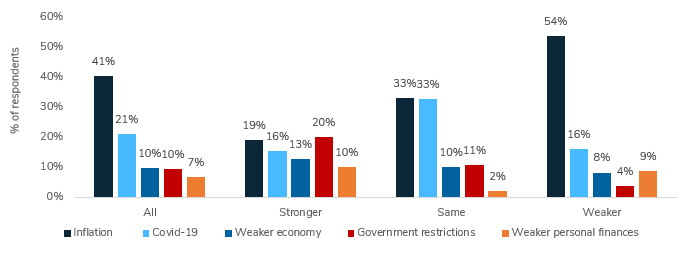

Figure 2: Top five concerns heading into 2022, by household expectations about their personal finances

Source: Retail Economics

[Article continued below]