Report Summary

29 December 2024 – 01 February 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Furniture & Flooring – Retail Economics Index

The Furniture and Flooring experienced a xx% decline in sales year-on-year in January, although this was an improvement from the xx% average drop seen over the past three months.

Despite a temporary rebound, the sector continues to face challenges, particularly with big-ticket spending, which is showing no signs of returning to previous levels. Several factors contributed to this decline:

Shift towards value-driven shopping habit

Rising inflation and ongoing cost-of-living pressures have made consumers more price-conscious, particularly during the January sales.

Shoppers are now prioritising value, as evidenced by a significant increase in promotional sales across the retail landscape.

Nielsen reported that xx% of supermarket sales were on promotion in January, the highest level since 2021.

Consumers are increasingly opting for discounted products and own-label items, pushing higher-priced categories like furniture into a more challenging position.

Stormy weather

January was marked by severe weather conditions, including Storm Éowyn, which hit parts of the UK with gusts of up to 100 mph and caused widespread power outages (Met Office).

This had a notable impact on in-store footfall, particularly in high street locations, as people were deterred from visiting physical stores due to travel disruptions and adverse weather conditions.

For the furniture & flooring, footfall in retail parks is especially crucial, as many stores are located there, making it a key driver for sales.

Reduced discretionary spending

Retailers are facing a tough consumer environment, with confidence dropping five points in early 2025 compared to December (GfK).

All five measures declined, showing worsening economic and personal finance expectations. The general economic situation dropped xx points to -xx, while forward-looking expectations fell by xx points to -xx, xx points lower than January 2024.

This cautious mindset is reducing discretionary spending, especially in Furniture and Flooring and prompting consumers to delay big-ticket purchases in favour of essential needs.

Labour market uncertainty

Labour market showed signs of weakness in January, with unemployment rising to xx% and job vacancies declining, creating a cautious environment for consumer spending and reducing disposable income (ONS).

These labour market challenges, combined with high inflation and cost-of-living pressures, are leading consumers to delay or reduce big-ticket purchases, as they prioritise essentials and experiences over discretionary spending.

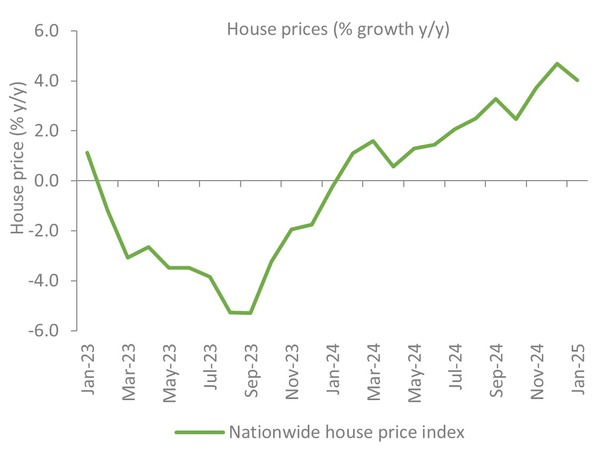

Housing market slowdown

House price growth slowed to xx% YoY in January, down from previous months, reflecting ongoing affordability constraints (Halifax).

Despite this, the average UK house price reached a record £xx, showing that prices remain elevated, which continues to challenge potential buyers.

Rising mortgage costs due to higher interest rates are putting significant pressure on first-time buyers and those looking to upgrade.

This has led to a continued slowdown in the housing market as many consumers face financial strain and are less willing to invest in home improvements

Take out a FREE 30 day membership trial to read the full report.

Housing market slowdown

Source: Nationwide, Retail Economics Analysis

Source: Nationwide, Retail Economics Analysis