Report Summary

29 December 2024 – 01 February 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Food & Grocery Sales

Food & Grocery sales rose xx% year-on-year in January, against xx% growth the same month a year earlier, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Several factors impacted this performance:

Consumer constraint: Shoppers continue to adjust to higher living costs and price pressures, cutting back in some areas while prioritising value amid an uncertain path to stable inflation and lower interest rates.

New Year health regimes: Health-focused trends drove purchasing in several categories as consumers embraced wellness-focused goals at the start of the year.

Less eating out: Cost-conscious consumers opted to dine at home in January, boosting grocery sales. Like-for-like sales fell across pubs (-xx%), restaurants (-xx%), and bars (-xx%), with London’s hospitality sector hit hardest (CGA-RSM).

Strong promotional activity: Promotional spending increased by £xx, comprising xx% of total supermarket sales – the highest January level since 2021 (NIQ).

Food inflation: Food and non-alcoholic drink inflation rose to xx% in January, the highest since March 2024 (ONS, CPI), while food store prices edged up to xx% (ONS, IPD), signalling c.xx% volume growth during the month.

Multiple sources track UK Food & Grocery sales, each using different methodologies, sample sizes, and reporting periods. Retail Economics provides a consolidated view by aggregating data from key sources, supported by panel insights (see here for more).

Major grocers look to cut costs

A fresh wave of job cuts is sweeping through UK supermarkets as grocers grapple with rising costs, shifting shopping habits, and efficiency drives.

Since the start of the year, supermarkets have cut over xx roles, with Sainsbury’s axing xx, Tesco removing xx, and Morrisons cutting xx+ amid rising cost pressures.

The Budget is shouldering much of the blame. Higher national insurance, a jump in the minimum wage, and new environmental levies have piled pressure on an industry already operating on wafer-thin margins.

The Retail Jobs Alliance warned that rising costs could see one in ten shop floor workers leave by 2028. Retail bosses have criticised tax increases and regulatory burdens, with Marks & Spencer’s CEO accusing the government of treating retailers like a “piggy bank.”

But job cuts are part of a longer-term shift. Supermarkets have been cutting costs for years, adapting to fierce competition, evolving consumer habits, and technology’s growing role. Labour-intensive areas like in-store cafés and bakeries are often first to go as grocers prioritise efficiency.

Rising labour costs are also making automation more viable. Retail Economics forecasts retailers and hospitality firms will invest £xx in digital transformation in 2025, including £xx in automation and AI to offset wage hikes.

Supermarkets face a tough balancing act, cutting costs while investing to stay competitive. The real challenge is making changes without cutting too deep. If service suffers, long-term competitiveness will too.

Take out a FREE 30 day membership trial to read the full report.

Sainsbury outpaced the market at 4.2% sales growth

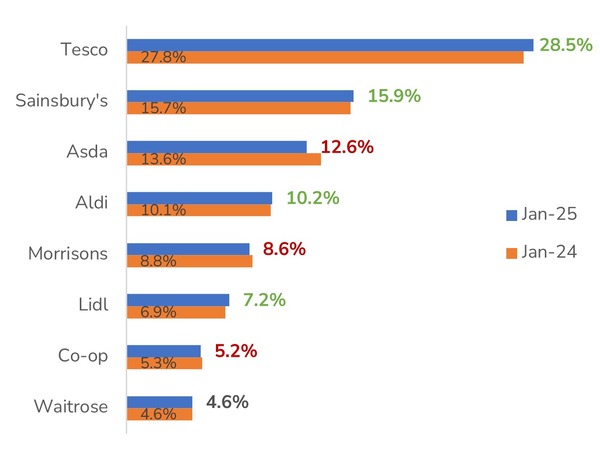

Source: Kantar, Retail Economics. UK Grocery Market Share (12 weeks to 26 Jan)

Source: Kantar, Retail Economics. UK Grocery Market Share (12 weeks to 26 Jan)