Report Summary

Period covered: January 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Subscribe to access this data or take out a free 30 day subscription trial now.

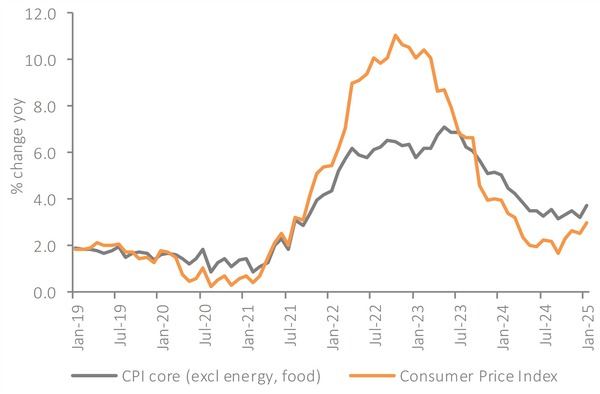

Inflation

Headline inflation rises: CPI inflation increased to xx% in January, up from xx% in December, exceeding market expectations of a xx% rise.

The increase was driven by higher transport and food costs, along with a sharp jump in private school fees following VAT changes.

Core Inflation edges higher: Core CPI, which excludes energy, food, alcohol, also rose, primarily due to higher education costs and services inflation, although underlying domestic pressures remain weaker than mid-2024 levels.

Goods and services inflation: Annual goods inflation rose to xx% in January, from xx% in December, reflecting higher food prices and petrol costs.

Services inflation also increased, rising to xx% from xx%, largely due to the VAT-related rise in private school fees and persistent rental cost pressures. Encouragingly, the rise in services inflation was lower than recent Bank of England forecasts.

Transport inflation rises: Transport inflation rose to its highest level in almost two years, driven by air fares and motor fuels, partially offset by second-hand cars. Air fares, which typically fall in January, recorded their smallest January drop in five years, in part due to data collection timings in the last two months.

Food Inflation accelerates: Food and non-alcoholic beverage inflation rose to xx% in January, the sharpest increase since March 2024. Monthly price rises were recorded across meat, bread, cereals, dairy, and soft drinks, offsetting declines in other categories.

Education costs surge: Private school fees rose xx% MoM following the new VAT policy. This was the single largest contributor to January’s higher services inflation rate.

Emerging supply chain pressures: While input prices remained in deflation, output prices turned positive in January, suggesting some cost pressures building in the supply chain. Geopolitical risks are weighing on oil and commodity prices, which could push up supply costs if they persist.

Financial Market Reaction: Financial markets responded to the inflation data by reducing the probability of a March rate cut to c.xx%, down from around xx% before the release.

Take out a free 30 day trial subscription to read the full report >

The headline inflation measure rose above expectations by 3.0% in January

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis