UK Retail Inflation Report summary

January 2025

Period covered: Period covered: December 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Subscribe to access this data or take out a free 30 day subscription trial now.

Inflation

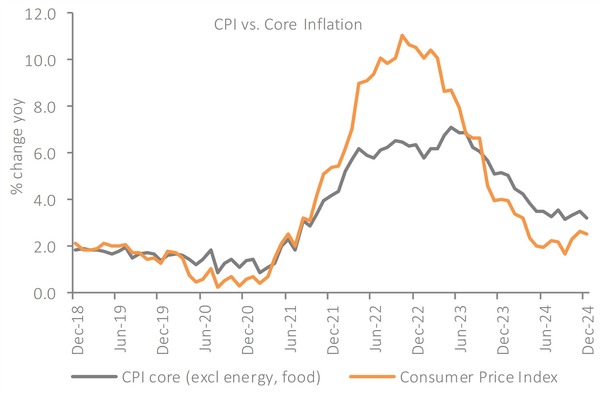

The headline Consumer Price Index (CPI) rose by xx% YoY in December, down from xx% last month. The annual core inflation rate (excl. food & energy prices) also slowed, from xx% to xx%.

Headline inflation slows: CPI inflation eased to xx% in December, down from xx% in the previous month and below economists' expectations of inflation remaining unchanged. Downward pressure from hotel prices and slower growth in tobacco costs were partially offset by increases in motor fuel and second-hand car prices.

Core Inflation falls further: Core CPI, excluding energy, food, alcohol, and tobacco, declined to xx% in December from xx% in November, reflecting moderating underlying price pressures.

Goods and services inflation: Annual goods inflation moved closer to zero at -xx% , up from -xx% in November. Services inflation dropped to xx% from xx%, the lowest level since March 2023, driven by a notable fall in airfares. While encouraging, services inflation remains above pre-pandemic norms and is a key focus for the Bank of England.

Transport Prices mixed: Transport prices fell xx% YoY in December, up from xx% in the previous month. Motor fuel prices exerted upward pressure, with petrol and diesel prices rising month-on-month but still down on an annual basis. Second-hand cars saw their first annual inflation increase since mid-2023.

Elsewhere, airfares rose by xx% month-on-month, marking the lowest December increase since 2019, and its third-lowest November rise on record.

Restaurants and hotels prices ease: Annual inflation for restaurants and hotels fell to xx% in December, the lowest rate since July 2021. Hotel prices dropped by xx% on the month, contrasting with a xx% rise a year ago, while restaurant and café price growth slowed slightly.

Food Inflation stable: Food and non-alcoholic beverage inflation was unchanged at xx% in December with monthly price increases in fruit and sugar, jam and confectionery offset by declines in bread, cereals, and soft drinks.

Supply chain pressures: Input prices remained in deflationary territory, but output prices (factory gate prices) turned positive for the first time since August 2024, hinting at potential cost pressures ahead.

Financial Market Reaction: Financial markets responded to the inflation data by increasing the probability of a February rate cut to xx%, up from xx% before the release. The pound dipped modestly, reflecting expectations of monetary easing, while gilt yields held steady.

Take out a free 30 day trial subscription to read the full report >

The headline inflation measure rose by 2.5% in December

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis