Report Summary

29 December 2024 – 01 February 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Health and Beauty sales

Health & Beauty sales rose by xx% YoY in January, compared to xx% growth in January 2024, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

The Health & Beauty sector saw the second-largest growth across the retail sector, with electricals being the only category to register a higher growth rate.

Sales drivers

Several key factors influenced this performance:

Inflation increase: Inflation rose by xx%, driven by fuel, transport costs and air fares. The start of January saw key essentials such as bus fares and energy prices rise in price, putting pressure on disposable incomes.

Focus on value: Rising inflation made shoppers even more focused on January sales discounts across categories such as electricals, health & beauty and clothing. Homewares, electricals and health and beauty saw small uplifts as consumers sought out bargains,.

Wellness trends: Traditionally a time of focus on health and fitness, January brought increased interest in wellness-driven purchases such as supplements and LED face masks.

Stormy weather: Storm Eowyn, the strongest UK storm in 10 years, brought winds over 100mph and caused widespread power outages in Northern Ireland and Scotland. Footfall plunged xx% YoY in Scotland during the month. Storm Herminia, meanwhile, brought heavy rain and strong winds across southern England and Wales, causing flooding in Somerset.

Beauty continues to survive consumer cutbacks

After a subdued Q4 in 2024, cautious consumer spending carried on into January as shoppers continue to manage their finances carefully following the cost-of-living crisis.

health and beauty continued to outperform other non-essential categories, partly driven by January’s focus on wellness. This was compounded in 2025 by the growing role of social media in driving wellness trends and purchases.

Barclays reported health and beauty was supported by social media, with xx% of consumers buying wellness products and xx% making purchases based on trending content.

Digital strategy

In a difficult environment, retailers are focusing both on value-driven strategies to encourage spend, and on digital innovation.

Speaking at LIVE 2025, Boots chief digital officer Paula Bobbett highlighted data as the retailer’s “next frontier” in evolving healthcare services. Bobbett cited the success of its Advantage Card app and AI chatbot, with future plans to leverage data for predictive healthcare, including ovarian cancer prevention research with Imperial College.

Outlook

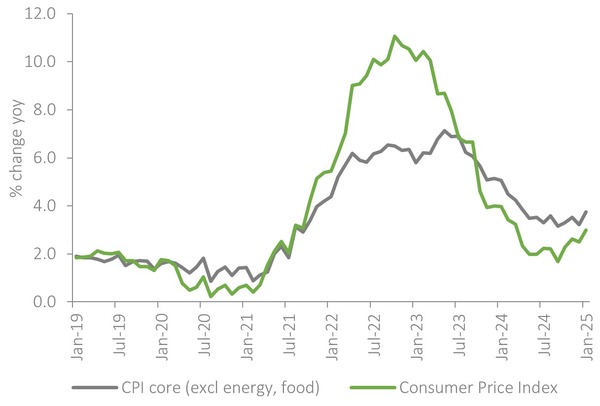

Headline inflation rose to xx% in January; CPI inflation is expected to peak at xx% in Q3 2025 due to increased global energy costs before falling back to its xx% target.

Despite the inflation increase, February saw the Bank of England reduce the Bank Rate to xx%. The lower rate could help to ease consumer caution; consumer confidence eased slightly in February, up xx points to -xx.

Retailers are gearing up for the April increases in employers’ national insurance and the minimum wage, with Next boss Lord Wolfson saying the changes will affect the number of jobs, particularly entry-level roles, available in the industry.

Take out a FREE 30 day membership trial to read the full report.

Housing market slowdown

Source: ReInflation rose by 3%, driven by fuel, transport costs and air farestail Economics, ONS

Source: ReInflation rose by 3%, driven by fuel, transport costs and air farestail Economics, ONS