UK Food & Grocery Sector Report summary

January 2025

Period covered: Period covered: 24 November – 28 December 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Food & Grocery Sales

Food & Grocery sales rose xx% year-on-year in December, against xx% growth the previous December, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Across the full Christmas period (November and December combined), Food & Grocery sales rose by xx% year-on-year.

Several factors impacted this performance:

Calendar distortions: Black Friday fell into the December trading period in 2024, unlike in the previous year. This saw Non-Food and Online sales rebound from November.

Promotional activity: Grocery sales were boosted by the highest levels of promotional activity in three years, with branded promotions account for xx% of grocery sales (four weeks to 28 December, NIQ).

Cautious spending: The flight to promotions comes as households continue to grapple with higher household bills (e.g. energy, mortgage, rents) and elevated interest rates.

Omnichannel outperforms: Online channels (+xx%) outpaced in-store sales, with best-in-class retailers excelling through strong loyalty propositions and advanced omnichannel capabilities (e.g., click-and-collect, home delivery, convenience). Retailers slower to invest in their capabilities, propositions, and operational efficiencies struggled for growth, losing market share to more agile competitors.

Stable inflation: Food inflation held steady at xx% in December (ONS, CPI), compared to near double-digit price rises a year earlier, contributed to tough annual comparisons and softer growth in value terms.

Promotions deliver solid Christmas for grocery

Despite a slow start, it was a solid Christmas overall for food retailers. December’s sales met expectations, with growth closely aligned to the full-year average for 2024 (xx%).

Conflicting narratives emerged around December’s performance, making it challenging to obtain a clear picture of retail sales.

Media reports focused heavily on seasonally adjusted figures from the ONS, which showed food store sales volumes at their lowest levels since April 2013.

These downbeat figures contrasted sharply with trading updates from major grocers and other sources, with both Kantar and NIQ reporting record-high take-home grocery sales in December.

This highlights the importance of understanding differences in data measures, including reporting periods, collection methods, and sample sizes (see table here).

Retail Economics helps cuts through the noise with an aggregated approach, while focusing on more accurate underlying year-on-year, non-seasonally adjusted figures.

Promotions accounted for xx% of grocery sales in December – the highest level of promotional activity in three years – driven by member prices and heavy discounts on festive staples, with retailers cutting prices on vegetables to as little as xxp.

Take out a FREE 30 day membership trial to read the full report.

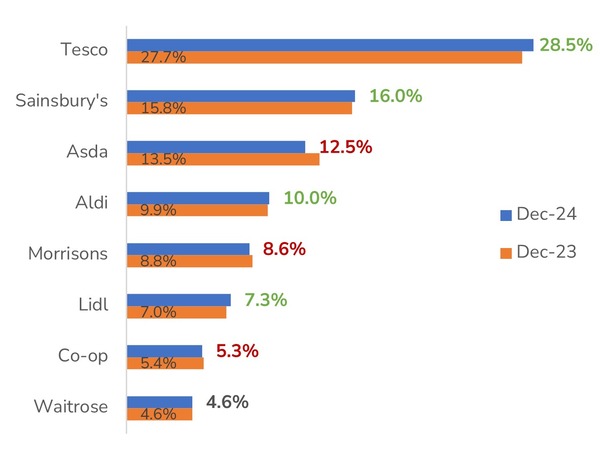

Tesco achieved its highest Christmas market share since 2016

Source: Kantar, Retail Economics. UK Grocery Market Share (12 weeks to 29 Dec)

Source: Kantar, Retail Economics. UK Grocery Market Share (12 weeks to 29 Dec)