UK Clothing & Footwear Sector Report summary

April 2024

Period covered: Period covered: 25 February – 30 March 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Clothing & Footwear Sales

Clothing sales fell xx% YoY, while Footwear sales xxxx by xx% YoY in March, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Apparel inflation is running at xx%, suggesting continued volume declines.

Clothing & Footwear sales’ performance in March reflects several upside (+) downside (-) factors, including:

Mild, wet weather (-): The weather throughout the month was wet and dull, with some counties in England, such as Kent, receiving their monthly average rainfall by the middle of the month. Temperatures were on the warmer side.

Early Easter (+): Good Friday and Easter Saturday fell in March in 2024, pulling forward some Easter sales compared to 2023, when Easter fell fully in April.

Subdued Mother’s Day (-): Mother’s Day failed to boost sales this year, with gift items such as jewellery and watches relatively unimpacted.

National Insurance cut (+): The Spring Budget in March brought news of a National Insurance cut from 10% to 8% for employed workers and 8% to 6% for self-employed. The average worker on £35,400 will save over £900 a year as a result of cuts in January and April.

Consumer resilience

Despite the rain, footfall rose slightly in March. MRI Software reported an increase of xx% compared to February. Annual footfall increased by xx% across all UK destinations, with high streets leading at xx%, retail parks at xx%, and shopping centres at xx%.

GfK’s Consumer Confidence Index remained at xx in March, xxxx from February.

The forward-looking measure for personal finances over the next twelve months increased xx points to xx, which is 23 points higher than the same time last year. This was the first positive score since xxxx.

Clothing and footwear faced competition for spend from the leisure sector, with spend at bars, pubs & clubs rising by xx% in March 2024 compared to xx% in February (Barclaycard). Meanwhile, cinemas enjoyed their busiest day of the year so far on Saturday March 2nd, right after the UK release date for ‘Dune: Part Two’.

Sentiment fragility

The clothing and footwear market continues to be among the first categories to be cut by consumers facing cost of living pressures and unseasonable weather which is impacting new season lines.

The backdrop for personal finances is uneven across households, masked by headline figures. Interest rates were held in March at xx%. This has dragged more consumers into financial difficulty amid higher borrowing costs, which is impacting younger and affluent consumers key to spending.

Over half (xx%) of consumers said they have some concerns with their personal financial situation in April, up two percentage points from the start of the year (Retail Economics).

Importantly, over a third (xx%) of consumers now have concerns about their level of credit card debt, while 12% said the repayment of debts and loans was their biggest concern in April – double the rate from January (Retail Economics).

This ongoing caution in spending for many saw just over two-fifths (xx%) of consumers indicated they would spend less on non-essential items over the next quarter. A fifth (xx%) said they would spend more.

Take out a free 30 day trial subscription to read the full report.

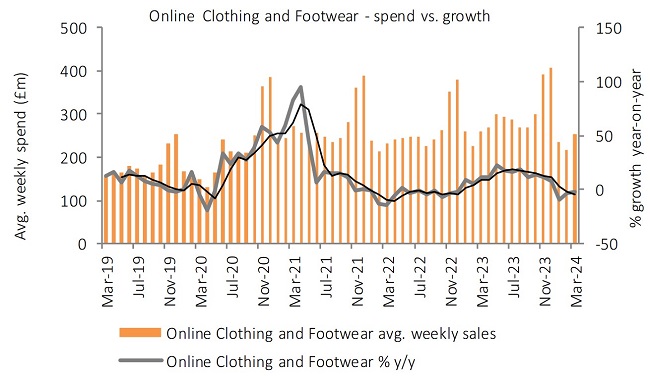

Online Clothing & Footwear - Spend vs. Growth

Source: ONS, Retail Economics

Source: ONS, Retail Economics