UK Clothing & Footwear Sector Report summary

December 2024

Period covered: Period covered 27 October – 23 November 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Clothing & Footwear Sales

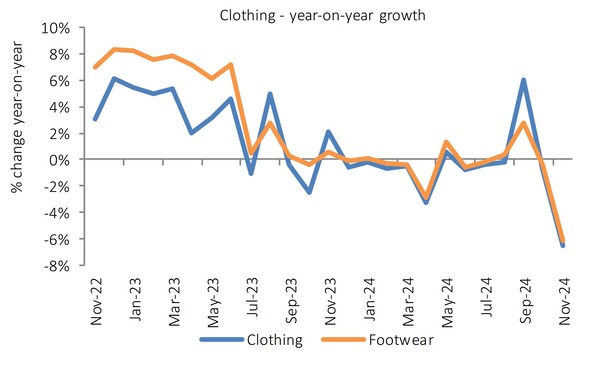

Clothing sales fell xx% YoY, while Footwear sales fell xx% YoY in November, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Key sales drivers

Clothing & Footwear sales’ performance in November reflects several upside (+) and downside (-) factors including:

Later half term (+): The half term holiday fell a week later in 2024, falling in the November trading period and boosting November sales as a result.

Cold weather (-/+): While the month started mild and dull, the UK shifted to much colder conditions mid-month as an Arctic maritime airmass moved in. While the colder temperatures helped seasonal sales, they also impacted footfall.

Storm Bert (-): Later in the month, Storm Bert brought wet and windy weather, with more than 150mm of rain and flooding in some areas.

Energy price cap (-): Ofgem raised the energy price cap for January to March 2025 by xx%, contributing to a continued mood of consumer caution, helping to push inflation higher and reduce disposable income for non-essential spending.

Consumer confidence (+): The GfK consumer confidence index rose three points to -xx in November, a modest but positive change. All five measures showed positive movement this month.

Outlook

While consumer confidence continues to rally post-Budget, headline inflation is expected to remain elevated in the near term as base effects from energy prices fade.

As a result, while interest rate cutting is expected to resume in Q1 2025, the probability of a cut at the MPC’s February is low.

This means affordability pressures and ongoing economic uncertainty may limit house price growth and transaction levels as borrowing costs remain high. Steady but slower growth is likely in 2025.

Take out a FREE 30 day membership trial to read the full report.

Clothing and Footwear year-on-year growth

Source: Retail Economics, ONS, seasonally adjusted

Source: Retail Economics, ONS, seasonally adjusted