UK Clothing & Footwear Sector Report summary

July 2024

Period covered: 26 May – 29 June 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Clothing & Footwear Sales

Clothing sales fell xx% YoY, while Footwear sales fell by xx% YoY in June, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Clothing & Footwear sales’ performance in June reflects several upside (+) and downside (-) factors, including:

Summer holidays (+): Consumers are buying for weddings, summer events and, as the school holidays approach, holidays abroad, driving sales as shoppers refresh wardrobes.

Dull weather (-): As the coolest June since 2015, the mild weather dampened seasonal sales. The end of the month saw a brief surge in temperatures, with highs of 30°C between 24 and 27 June. Retail Economics research found that xx% of shoppers have spent less than intended on clothing and footwear over the last three months due to the weather.

Euros (-): The European football championships kicked off on 14 June, with xx% of UK consumers planning to watch games in pubs and bars, according to a survey from CGA.

Stabilising economy (+): Although personal finances remain fragile, inflation held at xx% in June, and wage growth – at xx% in the three months to March according to the ONS – remains high. The economy grew faster than expected in Q1 supported by stronger household spending, and consumer confidence continues to strengthen.

Sentiment fragility

The clothing and footwear market continues to be among the first categories to be cut by consumers facing cost of living pressures, with heavy rain in April contributing to the challenges as consumers delayed spring summer purchases.

Despite this, some retailers continue to buck the trend and gain market share. Clothing sales at Marks and Spencer were up xx% for the year to end of April 2024, as the retailer’s turnaround plan pays off. Market share increased to xx%, up from xx% a year ago.

The retailer has focused on an overhaul of clothing design, as well as committing to a ‘first price right price’ strategy which helped support full price sales and reduce discounting.

It is also investing in its online and digital proposition, something many retailers are doing as they seek to attract sales in a difficult environment.

Small improvements to the customer experience can be significant. In 2023, online retailers lost £xx billion in sales due to basket abandonment driven by delivery-related concerns. xx purchases are abandoned at checkout (Retail Economics).

Clothing & footwear experienced the highest abandonment rate, with under-25s xx times more likely to abandon purchases compared to over 65s.

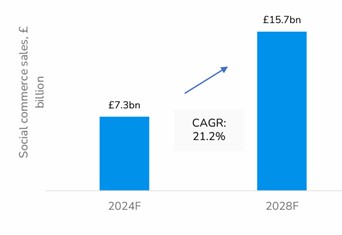

Social commerce expected to double over the next five years

The social commerce industry in the UK is predicted to more than double over the next five years, rising from £7.3 billion to almost £16 billion by 2028. Social commerce’s rate of growth is xx times the rate of overall e-commerce sales.

More than xx (xx%) of UK users have made a purchase directly through social media, either by clicking a link on shoppable content, or checking out directly within an app. This rises to almost (xx%) for those under 45, with xx (xx%) of Millennials purchasing on social media at least once a month.

Beauty and wellness is the most popular category for social commerce, followed closely by apparel. xx% of shoppers have purchased clothing or footwear via a social platform.

Take out a FREE 30 day membership trial to read the full report.

UK social commerce market to reach almost £16bn sales by 2028

Source: Retail Economics, TikTok

Source: Retail Economics, TikTok