UK Clothing & Footwear Sector Report summary

May 2024

Period covered: Period covered: 31 March – 27 April 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Clothing & Footwear Sales

Clothing sales fell xx% YoY, while Footwear sales decreased by xx% YoY in April, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Apparel inflation is running at xx%, suggesting continued volume declines.

Clothing & Footwear sales’ performance in April reflects several downside (-) factors, including:

The timing of Easter (-): Easter fell in March this year, and in April in 2023, leading to distorted year on year comparisons. Easter sales were pulled forward into March, impacting April’s performance. Clothing sales across both March and April combined were down xx% year on year, while footwear fell xx%.

Wet weather (-): April was an unsettled month weather-wise. The middle of the month saw some warmer weather but it was largely very wet, with 55% more rain than normal and with households delaying spending on spring summer lines as a result.

Rail strikes (-): A series of nationwide rail strikes throughout the month impacted people’s ability to get to retail destinations. More localised overtime bans also had an impact. This contributed to a xx% YoY fall in footfall (MRI Software).

Sentiment fragility

The clothing and footwear market continues to be among the first categories to be cut by consumers facing cost of living pressures, with heavy rain in April contributing to the challenges as consumers delayed spring summer purchases.

Despite this, some retailers continue to buck the trend and gain market share. Clothing sales at Marks and Spencer were up 5.3% for the year to end of April 2024, as the retailer’s turnaround plan pays off. Market share increased to 10%, up from 9.6% a year ago.

The retailer has focused on an overhaul of clothing design, as well as committing to a ‘first price right price’ strategy which helped support full price sales and reduce discounting.

It is also investing in its online and digital proposition, something many retailers are doing as they seek to attract sales in a difficult environment.

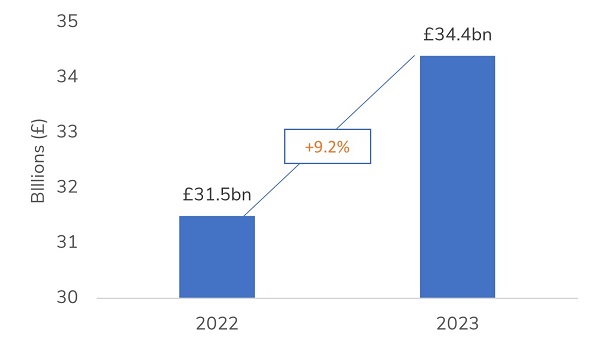

Small improvements to the customer experience can be significant. In 2023, online retailers lost £34.4 billion in sales due to basket abandonment driven by delivery-related concerns. One in four purchases are abandoned at checkout (Retail Economics).

Clothing & footwear experienced the highest abandonment rate, with under-25s four times more likely to abandon purchases compared to over 65s.

Tale of two retail sectors

Basket abandonment is increasingly prevalent among younger, middle-aged, and more affluent consumers. These groups are showing low tolerance for inflexible delivery options, and are abandoning purchases when they don’t see the services they expect.

This offers retailers an opportunity to capture more sales via premium delivery services. Nearly half of consumers (xx) are willing to pay for options such as same-day or next-day delivery. Middle- and high-income earners aged under 45 are particularly inclined to do so, with over xx% prepared to spend on services such as nominated time delivery that match their lifestyle.

The issue is compounded by increased financial caution, especially among upper and middle-income groups. More than half of those earning between £xx and £xx a year attribute the rise in basket abandonment to cautious spending, with rising debt costs having particularly affected this group.

Take out a free 30 day trial subscription to read the full report.

Online Clothing & Footwear - Spend vs. Growth

Source: Retail Economics, GFS

Source: Retail Economics, GFS