UK DIY & Gardening Sector Report summary

August 2024

Period covered: Period covered: 30 June – 27 July 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

DIY & Gardening Sales

DIY & Gardening sales declined by xx% YoY in June, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Several key factors contributed to this decline:

Mixed weather: July experienced persistently below-average temperatures in the first two weeks, including heavy rain on July 15-16, which negatively impacted outdoor activities like gardening. While the latter part of July saw a heatwave, this was not enough to recover the losses earlier in the month. (Met Office)

Consumer caution: Despite a slight improvement in the Consumer Confidence Index to xx in July, many households remain cautious, particularly regarding spending on big-ticket items and home-related purchases. Spending patterns remain influenced by households’ ability to manage rising mortgage and rent costs.

Focus on summer holidays: Consumers, eager to take advantage of the summer and post-pandemic freedoms, are allocating more of their discretionary budgets to travel and experiences rather than home-related activities. Spending on travel grew by xx% in July, reflecting strong demand for international holidays (Barclays).

The timing of major sporting events, including Euro 2024 and the Olympics, further diverted consumer attentions away from DIY & Gardening tasks. The excitement and engagement surrounding these events likely used funds that might have been used for home improvement projects.

Deflation in DIY: The DIY and gardening sector, along with other non-food retail categories, has been experiencing price deflation for several months. In July, this trend continued as retailers offered discounts and promotions to attract cautious consumers. Prices for household goods, including Furniture & Flooring and Homewares, declined by xx% year-on-year, marking the seventh consecutive month of deflation (ONS).

Housing market pressures: The UK housing market remains stable but subdued, with transactional activity constrained by persistently high mortgage rates, which stood at an average of xx% for a two-year fixed term in July. However, the recent interest rate cut by the Bank of England, from xx% to xx% in August 2024—the first reduction since March 2020—has sparked optimism that housing market activity will pick up in the months ahead.

Take out a FREE 30 day membership trial to read the full report.

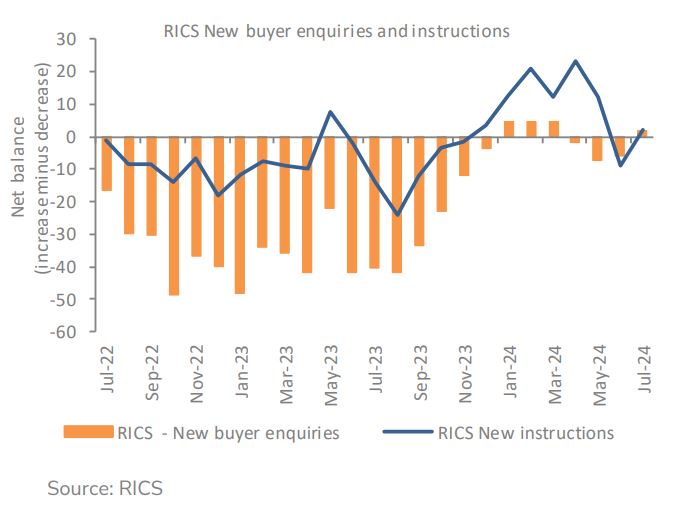

RICS New buyer enquiries and instructions

Source: RICS

Source: RICS