UK DIY & Gardening Sector Report summary

December 2024

Period covered: Period covered 27 October – 23 November 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

DIY & Gardening Sales

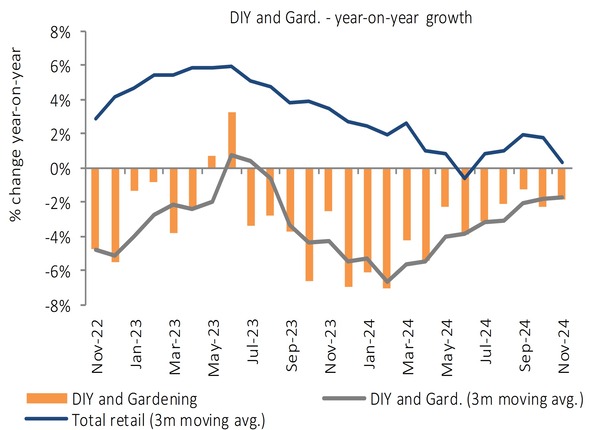

DIY & Gardening sales contracted xx% YoY in November, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

This marks an improvement from the xx% YoY decline in October and positions the sector second among all retail categories. Despite this, the negative growth reflects the ongoing pressures faced by DIY retailers.

Factors impacting the headline performance in the month include:

Timing of Black Friday: Early Black Friday promotions did little to offset the overall sales decline. The later timing of Black Friday (29 Nov) meant it fell outside November's reporting period but was included in last year's comparable, creating an artificial drag on sales. This particularly impacted non-food (-xx%) and online (-xx%) as associated retail spend shifts to December.

Adverse weather: November's weather, which shifted from mild to extremely cold, significantly reduced outdoor footfall, particularly affecting categories like outdoor furniture and BBQs. The month began with mild conditions, delaying seasonal shopping, before Storm Bert (23rd–25th) brought heavy rain and strong winds, further disrupting footfall and dampening consumer activity. This contributed to a slowdown in demand for DIY and outdoor products.

Economic pressures: Despite slight improvements in consumer confidence, ongoing economic challenges - such as flatlining growth, higher energy bills, and negative reaction from businesses to the Autumn Budget - maintained an environment of caution, constraining non-essential spending.

Outlook

Going into December, it is critical that delayed spending materialises to offset the poor start to the festive trading period.

Our research with MRI indicates a mixed outlook, with xx% of shoppers expecting to spend more on Christmas gifts compared to last year, while xx% anticipate spending less.

UK consumers are forecast to spend £xx on festive gifts this year, averaging £xx per person (Retail Economics).

Black Friday promotions and the additional boost from payday spending are expected to drive sales in the final month of the year.

However, the sector faces challenges in 2025, with increased National Insurance and the National Living Wage set to cost garden centres £xx (HTA).

These costs are expected to reduce net profits by xx% (HTA), leading to potential price hikes, reduced investments, and hiring freezes in garden centres.

Retailers will need to focus on seasonal opportunities and manage rising costs effectively to remain resilient in 2025.

Take out a FREE 30 day membership trial to read the full report.

DIY & Gardening sales declined in November

Source: Retail Economics, ONS, seasonally adjusted

Source: Retail Economics, ONS, seasonally adjusted