UK DIY & Gardening Sector Report summary

July 2024

Period covered: 26 May – 29 June 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

DIY & Gardening Sales

DIY & Gardening sales declined by xx% YoY in June, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

ONS data shows the wider Household Goods category faced shop price inflation of xx% in June.

Within household goods, both DIY & Gardening and Furniture & Flooring (xx%) experienced a similar decline in sales, while Homewares (xx%) performed much better.

Several factors affected this performance

Cooler weather: Compared to last year’s record June temperatures, June this year was wetter and cooler (Met Office), dampening gardening and outdoor-related DIY spending.

Deflation: ONS data shows the wider Household Goods category faced shop price inflation of xx% in June, as input prices head lower, and DIY retailers turn to promotional activity in response to weak demand. This is contributing to sales declines in value terms.

Cautious Consumers: Personal finances are improving, as inflation returns to target and real wage growth strengthens. Yet, many households remain cautious, adopting a ‘wait and see’ approach in June as the run-up to a general election created uncertainty.

Holidays prioritised: Consumers are prioritising spending on travel and experiences this summer, with less time devoted to DIY & Gardening projects. Holidays have become an almost non-negotiable spend for households this year, as consumers seek to escape the lacklustre UK weather and enjoy overseas travel missed during the pandemic.

Social commerce opportunities

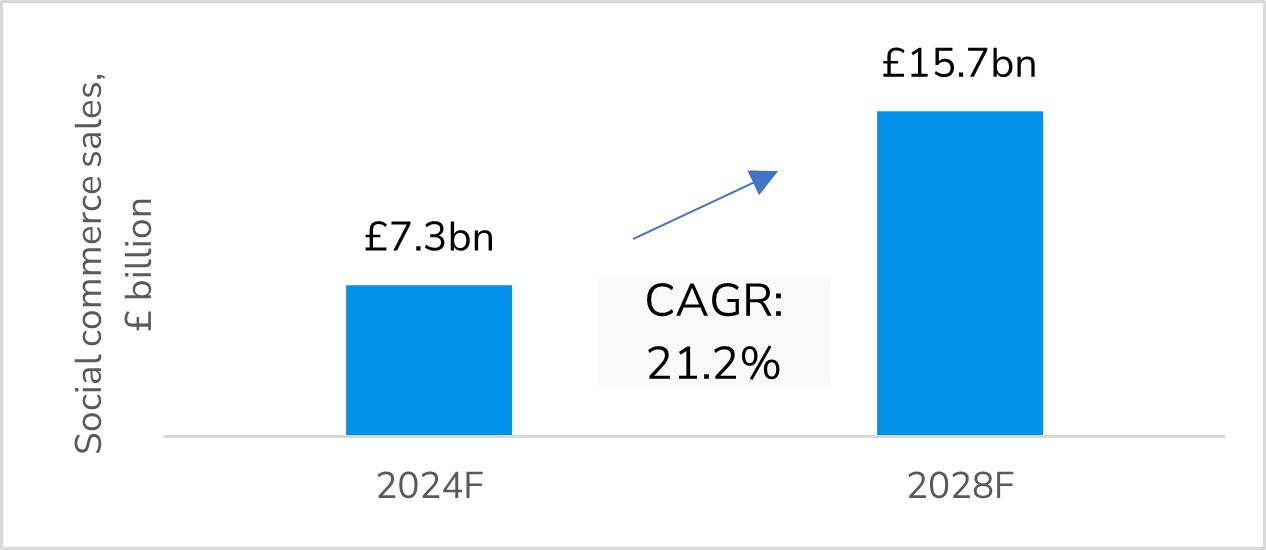

As the digital marketplace evolves, more consumers are turning to online platforms. Retail Economics research reveals that social commerce is set to more than double in the UK by 2028 to reach almost 16bn in sales.

Half of UK adults have made purchases through social media, with this figure rising to xx% for those under 45, and xx% of Millennials making monthly purchases

xx% of users have bought Home & DIY products directly via social and entertainment platforms, behind only Beauty & Wellness (xx%) and Clothing & Footwear (xx%).

Social commerce is set to account for xx% of the total online sales, up from xx% today. This shift offers businesses a significant opportunity to tap into a vibrant, growing market and expand their online sales.

Take out a FREE 30 day membership trial to read the full report.

Social commerce offers huge opportunities for Home & DIY

Source: Retail Economics, TikTok

Source: Retail Economics, TikTok