UK DIY & Gardening Sector Report summary

October 2024

Period covered: Period covered: 25 August – 28 September 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

DIY & Gardening Sales

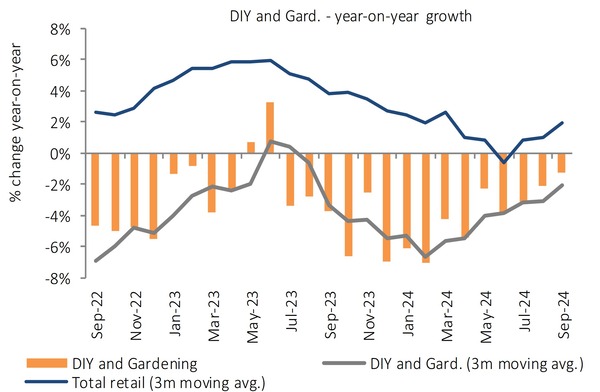

The DIY & Gardening sector experienced a xx% year-on-year decline in September, making it the second-worst performing retail category.

However, this represented an improvement over the three-month average decline of xx%, as growth in September marked the sector's best performance since June 2023.

Garden centres show resilience

Garden centres saw a xx% YoY rise in spending growth (Barclays), with overall sales and transactions up xx% from September 2022, despite weaker demand for larger items like garden furniture (Horticultural Trades Association).

Favourable weather, with xx times more sunshine and temperatures nearly two degrees warmer than last year, boosted footfall at retail parks, leading to strong sales in garden tools and plants, and a xx% surge in bulb sales as consumers prepared for autumn (HTA).

Non-gardening areas also thrived, with xx% growth in transactions as compared to September 2022 at cafes and restaurants, reflecting their appeal as popular local leisure spots.

Households focus on energy-efficiency

Amidst economic pressures, consumers demonstrated a shift towards practical, cost-saving projects.

With household energy bills set to rise by £xx to £xx from October, consumers prioritised investments that could help reduce long-term costs.

This trend was also influenced by the planned elimination of winter fuel payments, worth up to £xx for xx million pensioners, driving older demographics to invest in measures that lower heating expenses.

Weather impact on consumer behaviour

September's weather was marked by fluctuating conditions, starting warm but cooling sharply by the 11th due to Arctic air, followed by a brief warm spell mid-month, and ending with cooler temperatures (Met Office).

Growth in non-essential, but DIY spending slows

Even though non-essential spending across consumer spending grew by 2.7% in September, this increase did not translate into the DIY and home improvement sector (Barclays).

The rise in non-essential spending was driven by promotions, including Clothing & Footwear sales, and entertainment spending increasing by 14.4%. However, spending on DIY projects fell by 5.0% (Barclays).

Take out a FREE 30 day membership trial to read the full report.

Brief sunny spell boosts garden sales

Source: Retail Economics, ONS

Source: Retail Economics, ONS