UK Food & Grocery Sector Report summary

October 2024

Period covered: Period covered: 25 August – 28 September 2024

3 minute read

Food & Grocery Sales

Food & Grocery sales dipped xx% YoY in September, against strong xx% growth a year earlier, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Overall, across Q3 (Jul-Sep), Food & Grocery sales increased xx% YoY.

Key factors impacted this performance:

Lower inflation: Stabilising food inflation, compared to double-digit price rises a year ago (Sep 23: xx%), is contributing to tough comparisons and slower sales growth in value terms.

Wet weather: September brought mixed weather, starting warm but turning cooler with heavy downpours. Southern England had its third wettest September on record, hurting retail footfall while supporting online sales, as shoppers opted for classic warming staples.

Budget caution: Consumer confidence plunged by seven points in September, dropping to -xx (GfK index), reversing much of the year’s earlier progress. Concerns over personal finances grew amid warnings of tax hikes and a 'painful' Autumn budget, alongside the withdrawal of winter fuel payments for pensioners, aimed at addressing the £22 billion public finance shortfall.

Focus on value: Despite easing inflation, real wage growth (xx%), and expected interest rate cuts, many shoppers remain cautious, prioritising savings as they haven’t yet felt a sustained recovery in personal finances. Retailers are responding by keeping prices low and boosting promotions to drive spending.

Food dips in September

September’s slowdown in food sales is not uncommon as consumers adjust to post-summer routines. However, unseasonably wet weather and challenging comparisons with last year’s high inflation resulted in a sharper-than-expected dip in sales values and volumes.

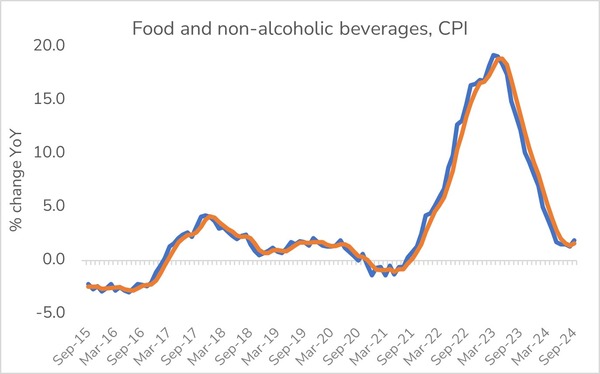

Food and non-alcoholic drink inflation rose to xx% in September, up from xx% in August, marking the first increase since early 2023, but still within a manageable range (ONS).

Prices in grocery rose fastest for chilled soft drinks and confectionery, while staples like household paper and pet food saw the largest price drops.

Shoppers are visiting stores more frequently, almost xx times a week, and spreading purchases across eight different retailers, with the average basket size down xx% year-on-year, at £xx (NIQ, four weeks ending 5 October).

Despite easing inflation and rising disposable incomes, many households continue cherry-picking offers and are beginning to budget for Christmas by spreading out festive costs.

The value battle remains intense, with supermarkets leveraging loyalty schemes and member pricing to drive grocery spend.

Take out a FREE 30 day membership trial to read the full report.

Food inflation now back to manageable levels

Source: Retail Economics, ONS

Source: Retail Economics, ONS